Most cities, counties, and school districts are right now in the process of adopting budgets and determining tax rates for the next fiscal year. In some cases, these local decisions will increase the cost of government and put upward pressure on property tax bills.

Given the very real prospect of tax increases, now is the time for Texans to learn what’s happening in their communities and get involved in the decision-making process—while there’s still time. Doing so could mean the difference between affordability and out of luck.

To illustrate what may be at stake, consider the city of Jersey Village.

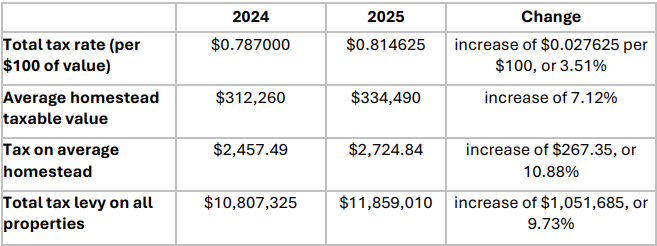

According to the city’s Notice of Public Hearing on Tax Increase, the average Jersey Village homeowner’s tax bill may soon rise by 10.88%, or $267.35 more per year. Should this happen, the city’s total tax burden will grow from $2,457.49 this year to $2,724.84 next year.

The reason for this potential tax increase is the city’s unwillingness to lower its tax rate in response to rising property values. For the coming year, city officials have suggested increasing the tax rate, from $0.787 per $100 of value to $0.814625 per $100 of value, despite the fact that the average homestead’s taxable value is expected to climb by 7.12%. The city has discretion in the tax rate-setting process, but does not appear motivated to use it to properly balance rates and values.

In an ideal world, city officials would reject the proposed tax rate and adopt the no-new-revenue (NNR) tax rate instead. The NNR rate is the tax rate that would effectively hold tax receipts constant and “giv[e] homeowners and businesses a chance to catch their breath.” For FY 2026, the NNR rate is $0.749438 per $100 of value or approximately 6.5-cents less than what is currently being considered.

A formal hearing and discussion on the city’s tax rate will occur shortly, per its public notice.

- A PUBLIC HEARING ON THE PROPOSED TAX RATE WILL BE HELD ON August 18, 2025 AT 7:00 pm AT Jersey Village Civic Center, 16327 Lakeview Dr, Jersey Village, TX 77040.