President Trump’s second term will be remembered for the rapid re-ordering of global supply chains. Trump’s tariffs target the reshoring of industrial production, and his tax plan in the One Big Beautiful Bill (OBBB) provides massive tax incentives to make capital expenditures in the United States.

Nebraska has an opportunity to put itself at the front of the line for industrial reshoring by matching Trump’s federal tax incentives in its state tax code. The operative federal tax change – known as full expensing or 100% bonus depreciation – is not only worth matching to mirror the federal system, but also because it is the single best tax incentive for capital expenditures per dollar of foregone tax revenue.

To understand Nebraska’s opportunity, we will first look at the connection between taxes and growth to zero-in on the corporate income tax as major tax most sensitive to economic growth per dollar of tax revenue. Then, within the corporate tax system, we will establish bonus depreciation as a superior incentive for capital expenditures compared to corporate rate cuts.

Evidence on Taxes and Growth

Economic studies consistently show that reductions to corporate and individual tax rates have a greater pro-growth impact than cuts to consumption (sales) and property taxes.

A 2008 study from the Organization for Economic Co-operation and Development (OECD) found that reliance on property taxes is least distortive to economic growth of the four major taxes. The study found that taxing immovable property is associated with higher growth as compared to taxing income and consumption.

A 2012 study from the International Monetary Fund found similar results using data from 1970-2009 across 69 countries. Income taxation, and in particular corporate income taxation, has a much more detrimental impact on growth than consumption or property taxes.

Research published in the Quarterly Journal of Economics using a 1946-2012 time series found that a 1% reduction in the marginal (top) income tax rate led to a 0.78% increase in GDP by the third year.

Another study in the National Bureau of Economic Research found that a 1% reduction in the state corporate tax rate leads to a 0.2% increase in employment and 0.3% increase in wages.

A study looking at the United Kingdom found that income tax rate cuts have a large impact on GDP, while consumption (sales) tax cuts do not have a significant impact on GDP. Shifting the burden of taxation from income to consumption results in economic expansion.

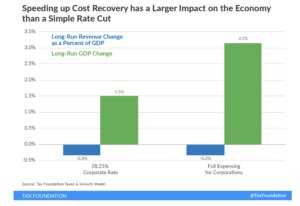

Corporate income taxation is near universally found to have the greatest impact on economic growth. In addition, a specific corporate tax reduction known as “full expensing” or 100% bonus depreciation creates greater economic growth per dollar of foregone tax revenue compared to cutting corporate tax rates. Full expensing spurs more investment than a corporate rate cut because when full expensing is implemented, every dollar of tax relief incentivizes new investments, while the lion’s share of foregone revenue from a corporate rate cut comes from the returns on legacy investments.

Both corporate tax reforms are fantastic for growth, but full expensing is better. Tax Foundation modeling has found that tax relief via full expensing has double the impact on economic growth (per dollar of foregone revenue) compared to a corporate rate cut.

This gives Nebraska a timely opportunity to capitalize on federal tax reform to boost economic growth by matching federal tax incentives for capital expenditures in the Cornhusker State.

First, the One Big Beautiful Bill (OBBB) created 100% bonus depreciation for (i) research and experimentation costs and (ii) machinery and equipment costs. Nebraska currently allows only 60% bonus depreciation for these asset classes. Nebraska should adopt the federal standard of permanent full expensing for these asset classes to maximize the Cornhusker State’s leading role in reshoring U.S. supply chains.

In addition, the OBBB created 100% bonus depreciation for production facilities for 2025, 2026, 2027 and 2028. This is a massive change in tax policy. Previously, capital expenditures in production facilities were written off over 39 years! Therefore, if Nebraska can match the federal government’s bonus depreciation for the next 4 years, it can outcompete other states in positioning itself for new investments.

Finally, tax studies show that taxation of immovable property has a relatively small impact on growth. But taxing movable property, such as tangible personal property, has an outsized impact on growth and production investments. Nebraska can maximize capital expenditures by phasing out its $250mm TPP tax with state revenues. We will consider this option in a follow-up blog on property tax targets.