Most cities, counties, and school districts are right now in the process of adopting budgets and determining tax rates for the next fiscal year. In some cases, these local decisions will increase the cost of government and put upward pressure on property tax bills. In a few cases, local government action will cause tax bills to soar.

Given the very real prospect of near-term tax increases, now is the time for Texans to learn what’s happening in their communities and get involved in the decision-making process—while there’s still time. Doing so could mean the difference between being able to afford your home or getting priced out.

To better illustrate what may be at stake, consider McLennan County.

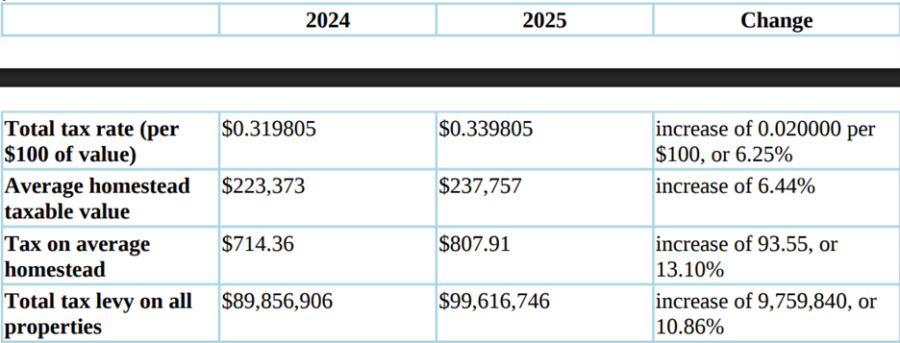

According to its newly-published Notice of Public Hearing on Tax Increase, the average McLennan County homeowner’s tax bill could soon rise by 13.1%, or an additional $93.55 per year. Should local elected officials adopt the proposed tax rate, then the county’s total tax burden will grow from $714.36 to $807.91 annually.

One reason for such a heightened increase is that county officials are considering imposing a higher tax rate while at the same time property values are growing.

For 2025-26, officials have proposed increasing the tax rate from $0.319805 per $100 of value to $0.339805 per $100 of value, representing a growth of 6.25%. Meanwhile, the average homestead’s taxable value is expected to rise by 6.44%. The combination of these two factors—higher rates, higher values—will force tax bills up.

Of course, there is no requirement that McLennan County officials adopt the proposed tax rate. In fact, there is a better, friendlier option available for officials to consider, which is the no-new-revenue (NNR) tax rate. The NNR rate is the tax rate that would effectively hold tax receipts constant and “giv[e] homeowners and businesses a chance to catch their breath.” For 2025-26, the NNR rate ($0.312574 per $100 of value) is less than the proposed tax rate ($0.339805 per $100 of value), with the difference equating to almost 3-cents.

Tax-weary Texans will be able to voice their concerns at an upcoming formal hearing. Per the county’s public notice, the date, time, and location are listed below.

- A PUBLIC HEARING ON THE PROPOSED TAX RATE WILL BE HELD ON August 19, 2025 AT 5:30 PM AT Commissioners Courtroom of the McLennan County Courthouse, First Floor West Wing, 501 Washington Ave, Waco, TX 76701.