The front-running candidate for New York City mayor, Zohran Mamdani, has said he can finance his costly campaign promises – including free buses and universal child care – by taxing only a sliver of the city’s residents and businesses.

Mamdani’s hike in the city income tax would exclusively target people who make more than $1 million per year, which is about 1 percent of filers. His proposed increase in corporate taxes would affect about 1,000 of the city’s 250,000 businesses.

His campaign estimates that the two proposals would generate an additional $9 billion per year, which would an 11 percent increase in tax revenues.

Before going ahead with these plans, city and state leaders should consider how much money those narrow groups are already pumping into government coffers – and the broader economy – and whether New York should risk chasing some of them away.

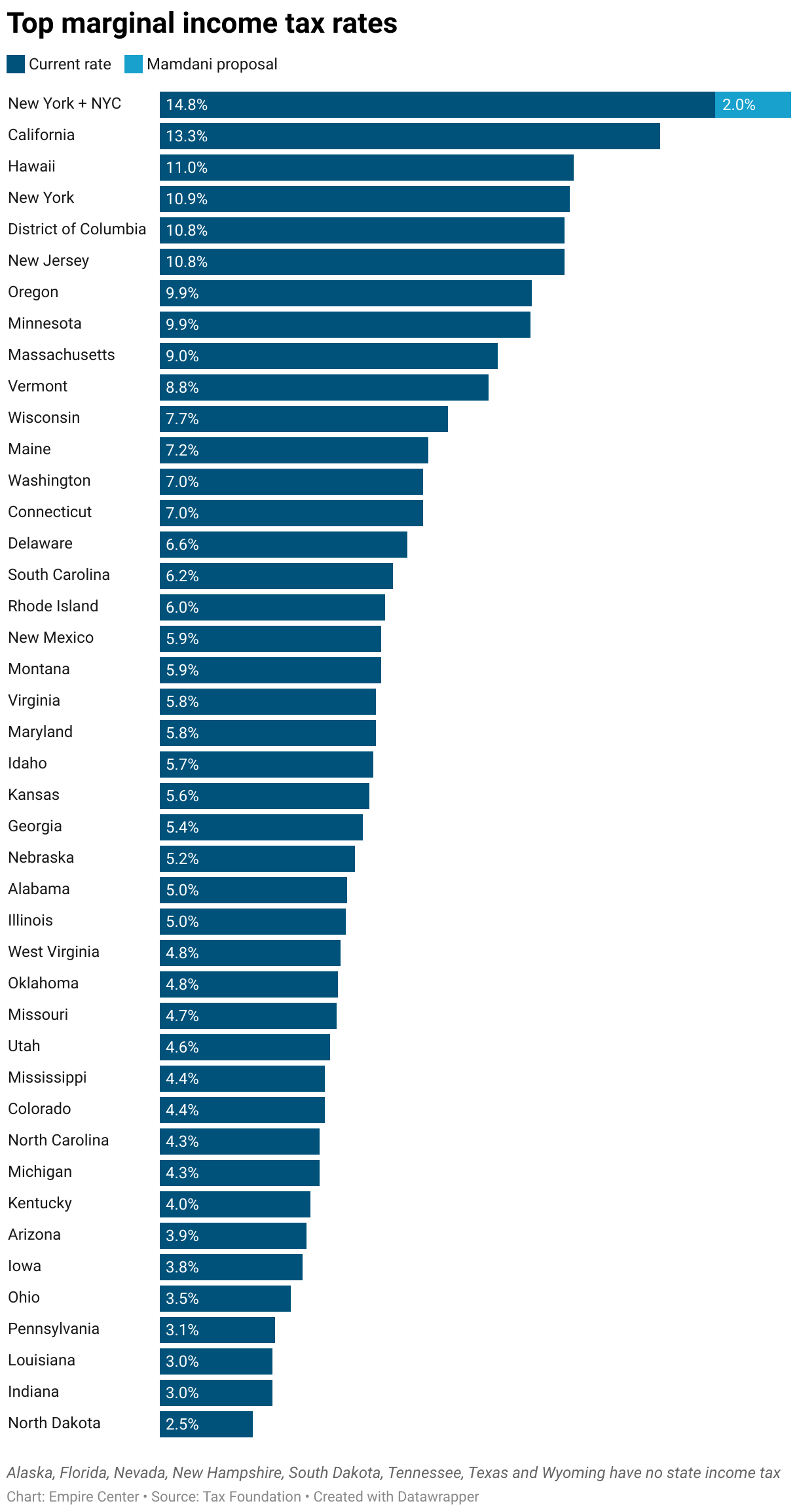

New York City’s wealthiest residents currently pay the highest non-federal income taxes in the U.S. The top marginal rate, applying to people with incomes of $25 million or more, is just under 14.8 percent – including a state tax of 10.9 percent and a city tax of 3.876 percent.

That’s one-and-a-half points higher than the No. 2 state, California, and almost triple the national median of 5 percent. Eight states, including Florida and Texas, have no income tax.

Mamdani is proposing to hike the city tax by 2 percentage points – or 52 percent proportionally – for incomes over $1 million. That would lift the top marginal city-state rate to 16.8 percent, which would be three-and-half points higher than any other state.

Currently, the top 1 percent of city taxpayers paid 40 percent of the city’s income tax in 2022. In other words, two-fifths of the city’s income-tax revenue came from about 34,000 filers.

Income millionaires similarly accounted for 41 percent of the state’s income tax revenue in 2023.

If Mamdani’s proposal were to become law, the share of city income tax revenue generated by the top 1 percent of filers would likely rise to more than 60 percent.

Mamdani is also proposing to hike the state’s top corporate tax rate by about half, up to 11.5 percent from its current maximum of 7.25 percent. This would match the corporate rate in New Jersey, which is the highest in the U.S. His campaign has estimated that this increase would apply to only about 1,000 of the most profitable companies.

Notably, his plan focuses on the state’s corporate tax – the revenue from which flows to state programs – as opposed to the separate corporate tax levied by the city. The summary in Mamdani’s campaign literature does not explain how raising a state tax would support his agenda in the city.

If these proposals do make it through Albany, most of the affected individuals and companies would probably stay put. As then-Mayor Michael Bloomberg argued in 2003, New York is a luxury product for which many people are willing to pay a luxury price.

That said, the net tax cost of living in New York City has roughly doubled since Bloomberg made that comment – a result of the federal government capping the deduction for state and local taxes in 2017, and the state government sharply increasing taxes on higher incomes in 2021.

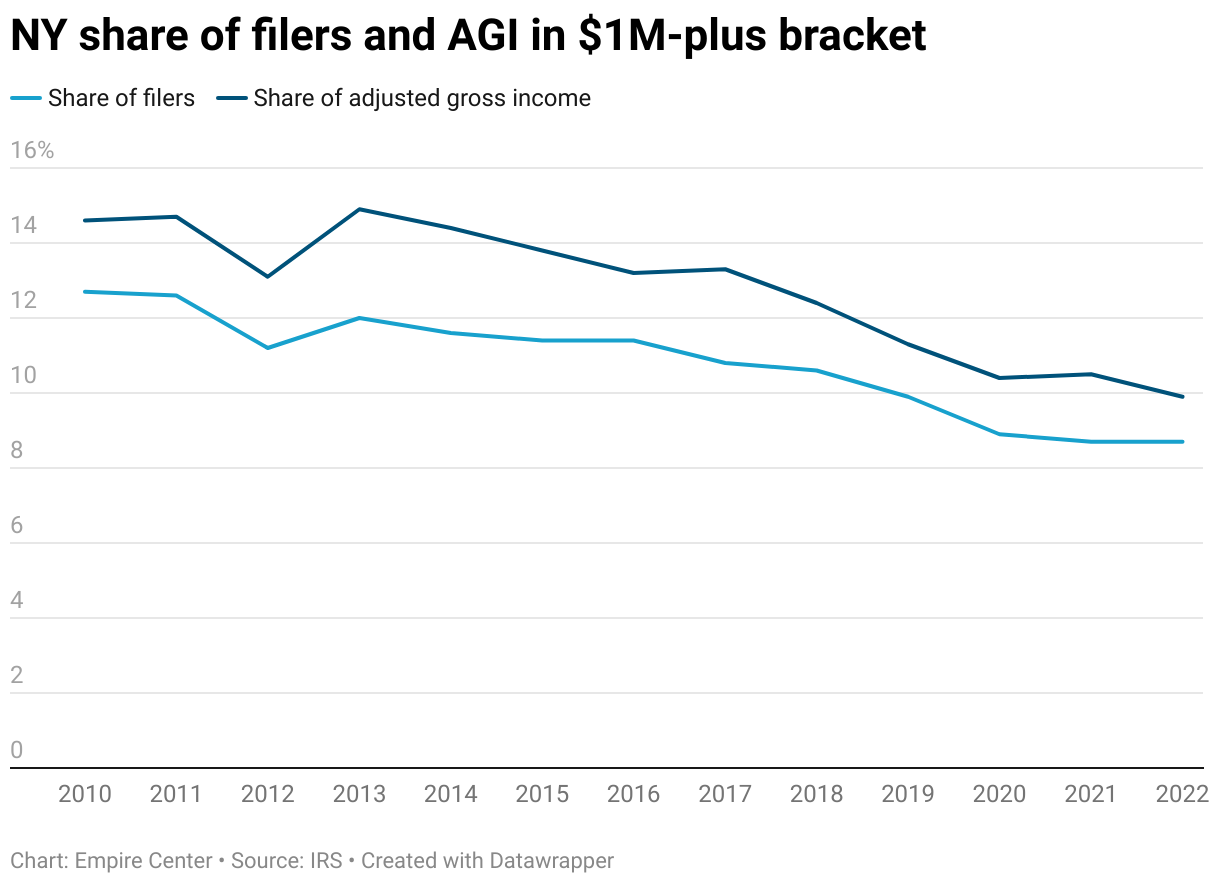

Meanwhile, the share of income millionaires choosing to live in New York has been declining – from 12.7 percent of the national total in 2010 to 8.7 percent in 2022, the last year for which data are available from the IRS.

State and city taxes probably aren’t the only factor driving this trend, but they do create a clear-cut financial incentive.

A hypothetical taxpayer with $25 million in taxable income would potentially save $1 million a year by moving to New Jersey, almost $2 million by relocating to Connecticut and as much as $3.7 million by going to Florida or Texas. Mamdani’s proposed two-point hike would add another $500,000 to each of those amounts.

A newly elected mayor seeking higher taxes on the wealthy would likely receive a warm reception from many of Albany’s ruling Democrats – many of whom have supported doing the same thing at the state level.

One figure standing in the way is Governor Hochul, who has declared herself opposed to raising taxes and raised concern about tax flight.

However, her opposition to taxing the wealthy is not absolute. As part of the state budget passed in April, Hochul proposed – and the Legislature approved – a five-year extension of “temporary” tax hikes on high-income taxpayers that were enacted in 2022. Instead of expiring in 2027, they are now due to continue through 2032.