Introduction

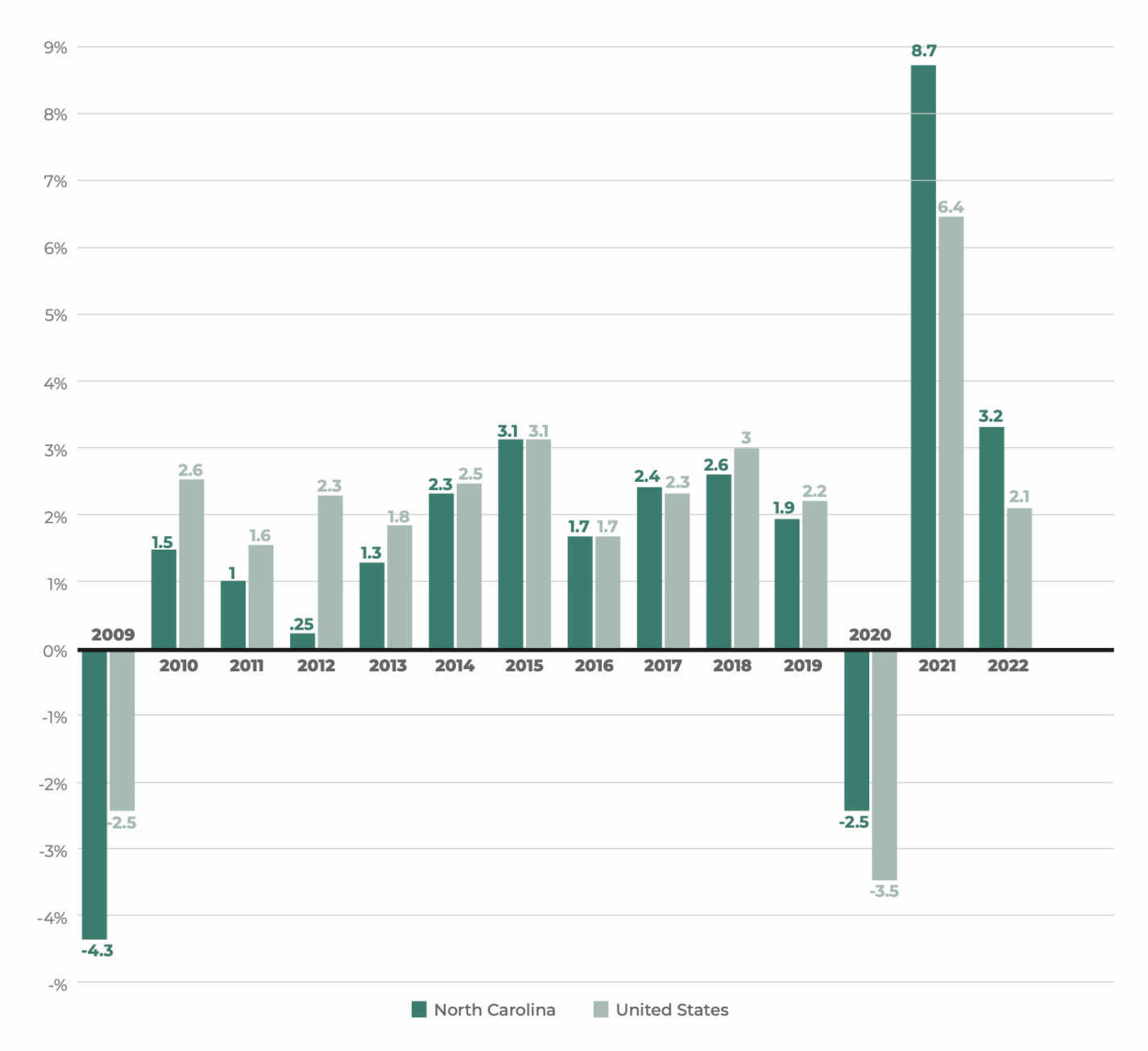

Beginning with the passage of tax and regulatory reform in 2013, the North Carolina General Assembly deliberately began to pursue policies meant to enhance overall economic growth, that is, to expand economic well-being typically measured by Gross State Product (GSP). Specifically, legislative actions have taken the form of policies designed to enable businesses to act efficiently and entrepreneurs to innovate and pursue opportunities. In short, lawmakers’ policies allowed the overall allocation of resources and investment to be determined by the free interaction of consumers and businesses. The GSP growth chart in this section shows the positive impact of this approach, especially over the last few years as North Carolina has been better prepared to weather and recover from COVID lockdowns.

For decades prior to this, North Carolina focused primarily on what is known as “economic development policy,” which is distinctly different from economic growth policy. Economic development policies target specific localities, regions, and businesses for special privileges at the expense of the rest of the state. These policies will typically create jobs or economic activity in one of a handful of industries or in one part of the state where subsidies or tax incentives are directed. This targeted growth, however, comes at the expense of jobs and economic activity elsewhere.

Although growth-enhancing policies have dominated both tax and regulatory reform efforts in recent years, unfortunately, economic development policy continues to lure politicians and bureaucrats who are anxious to direct private resources toward pet projects but who erroneously claim that they are promoting the good of the state. In reality, economic development policy allows state or local government officials to pick winners and spread the losses to taxpayers and other unsubsidized businesses. It is a form of central planning of resource allocation that is inconsistent with a free-market economy.

The starting premise behind policies to promote economic growth is that private entrepreneurs, using their own money or the money of voluntary investors, are best situated to know how to allocate resources efficiently. Policymakers who aim to promote economic growth, then, must see to it that property rights are secure, that entrepreneurs can use their property rights in any way they believe will be most productive, and that tax and regulatory policies do not get in the way of this entrepreneurial process. The best way for the state to promote economic growth is to remove barriers to entrepreneurship and avoid favoring one industry or form of economic activity over another through subsidies or special tax breaks.

But the political lure of targeted economic development policies continues to rear its growth-stifling head. For the last several legislative sessions, there has been a renewed interest in pursuing economic development policies. The governor’s office has handed out targeted tax breaks to Apple and VinFast, thereby committing unprecedented billions in taxpayer dollars to these companies over the course of three decades. Such massive commitments can often be regrettable. For instance, in September 2023, it was reported that VinFast had suffered $4.5 billion in losses over the two and a half years since it began delivering electric vehicles in 2021.

This schizophrenic approach to economic policy is like trying to increase the speed of a boat by investing in a bigger and more powerful motor (tax and regulatory reform policies) while simultaneously tossing a heavy anchor over the side (economic development policies). Sure, the boat may continue to move forward, and indeed it may increase its speed if the force of the new engine is greater than the drag of the anchor. But the new engine would work even better if the captain lifted the anchor completely.

Key Facts

- The belief behind economic development policy is that the decisions of entrepreneurs cannot be trusted. “Experts” in government believe they can decide more effectively what kinds of businesses and industries are appropriate for the state, and they then direct what would otherwise be private-sector resources toward the chosen companies. Economic development policies always transfer resources from other opportunities that market participants would have chosen.

- By reforming tax laws and regulations, North Carolina lawmakers have crafted policies with an eye toward enhancing economic growth. (See Tax Reform and Red Tape and Regulatory Reform.) On the other hand, North Carolina lawmakers continue to create special programs that include tax breaks and subsidies for favored industries and companies, and this distorts resource allocation.

- Dramatic reductions in the state’s corporate income tax rate and related reforms eliminated some of the special breaks that had been part of the law. Nevertheless, North Carolina’s tax system still penalizes investment and entrepreneurship by double taxing the economic returns to these activities, thereby hindering economic growth.

- Business subsidies that end up hampering economic growth might be most egregious at the local level, where city and county governments are in fierce competition with one another to attract particular investments. Their activity is authorized by the Local Development Act of 1925.

- The FY 2021-22 budget phases out the corporate income tax beginning in 2025 and zeroes it out in 2030.

Recommendations

- Repeal all economic development policies that grant special favors to particular businesses or industries.

Economic growth policy creates an environment that encourages private-sector entrepreneurship by removing government from the resource-allocation picture entirely. - Continue to pursue pro-growth tax reform by eliminating tax biases against investment and entrepreneurship.

This could be done by sticking to the legislative plan to eliminate the corporate income tax by 2030, abolishing or reducing taxation on capital gains, eliminating the franchise tax, and allowing businesses to deduct all expenses from their taxable income in the year that the expenses are incurred. (See Tax Reform.) - Continue to pursue regulatory reform by looking for ways to reduce outdated or ineffective regulations for which the benefits do not outweigh the costs.

For example, abolish laws that restrict growth in particular industries, such as certificate-of-need laws for hospitals and restrictions on the production and distribution of alcoholic beverages. - Eliminate or make changes to occupational licensing laws that tend to block entrepreneurship.

True entrepreneurship is what creates economic growth and meaningful jobs. (See Occupational Licensing.) - Repeal the Local Development Act of 1925.

This law authorizes local government entities to harm economic growth by pursuing economic development policies that use property tax collections to subsidize favored businesses.

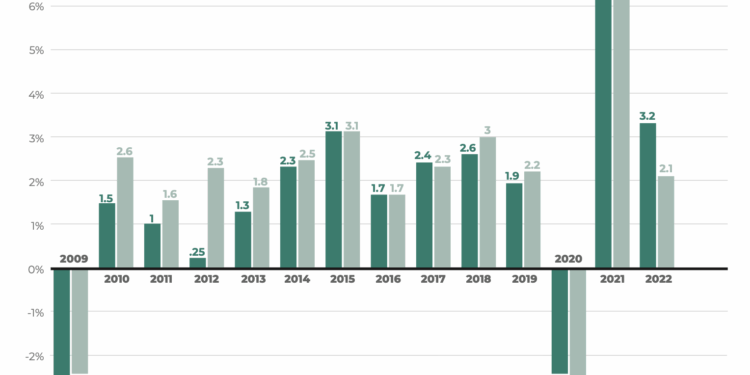

NC/USA Gross Domestic Product (GDP) Growth Comparison

Source: federal reserve bank of st. Louis, economic research division