Introduction

The North Carolina State Constitution requires the General Assembly to provide funding for “a general and uniform system of free public schools,” but it also allows the legislature to delegate additional responsibility to local governments. The legislature may “assign to units of local government such responsibility for the financial support of the free public schools as it may deem appropriate.”

That provision means that governing boards of local units of government may use local revenues to add to or supplement any public school or postsecondary school program. The North Carolina Supreme Court has interpreted it to mean the state must provide citizens with “access to a sound basic education” but that the legislature may delegate funding responsibility for schools to provide a “sound basic education” to local governments who may provide funds at or above what is required by the state legislature.

Further definition of how the public schools are funded can be found in the North Carolina General Statutes. G.S. § 115C-408 states that “it is the policy of the State of North Carolina to provide from State revenue sources the instructional expenses for current operations of the public school system as defined in the standard course of study” and that “[it] is the policy of the State of North Carolina that the facilities requirements of a public education system will be met by county governments.”

While these statutes are often cited as reasons for which level of government is responsible for what expenses, it should be noted that the statute does not assign any specific funding responsibilities. Rather, it lays out the goals or desires of the legislature. Even though the law is intended to give clarity, the matter has become less clear over time. State government is charged with providing for instructional expenses, and local governments are responsible for capital funding. In recent years, however, state government has provided more and more funding to local districts for capital costs.

County commissions have the primary responsibility of funding school district facilities at the local level. According to state law, “The needs and the cost of those buildings, equipment, and apparatus, shall be presented each year when the school budget is submitted to the respective tax-levying authorities. The boards of commissioners shall be given a reasonable time to provide the funds which they, upon investigation, shall find to be necessary for providing their respective units with buildings suitably equipped, and it shall be the duty of the several boards of county commissioners to provide funds for the same.”

As part of their joint responsibility, local government officials collaborate with boards of education to oversee the funding, construction, renovation, and maintenance of school district facilities. In most cases, county commissions and local boards of education accept discrete responsibilities for school facilities. School districts manage the school facilities program, while county commissions finance it. County commissions may allow local boards of education to build schools on property owned by the county. Commissions also have the power to acquire property on behalf of a board of education and construct, equip, expand, improve, or renovate a property for use by a local school system.

To fund school facility projects, county commissioners approve debt financing in the form of certificates of participation and installment purchase contracts (neither of which require voter approval) or general obligation bonds (which do require voter approval). The state also permits local governments to impose local option sales taxes and other supplementary taxes to pay for school facilities.

How much are North Carolina local taxpayers spending on school construction? According to the UNC School of Government, from November 2012 through November 2022, North Carolina voters approved 202 of 213 (95%) of county and municipal general obligation bond referenda. As a result, voters authorized counties and municipalities to issue nearly $14.4 billion in general obligation debt for school construction.

Considering the importance of school facilities and the expenses involved in building and maintaining them, county commissions and school boards must be committed to spending capital dollars wisely, utilizing efficient building practices, and adopting innovative solutions to ensure that all children have an adequate learning environment.

Key Facts

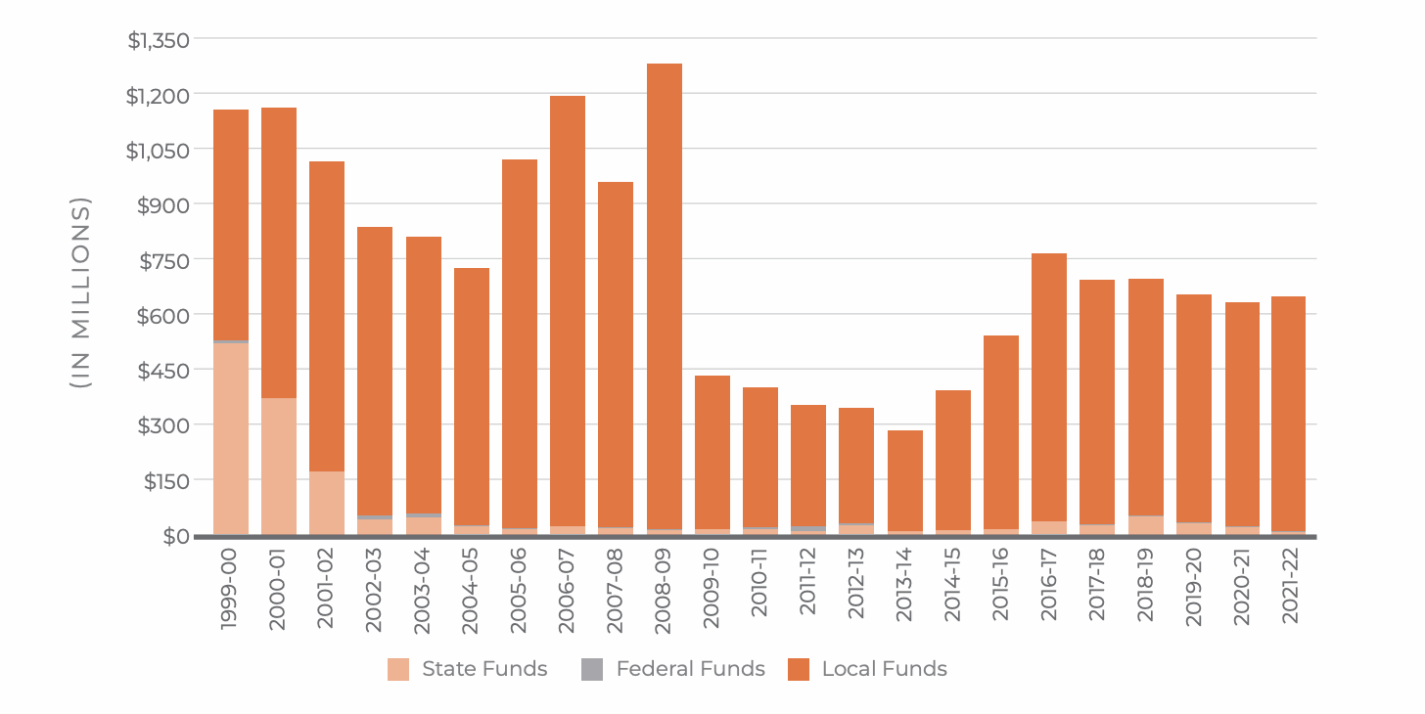

- Since 2000, North Carolina’s local governments have spent over $15.3 billion on school facilities, averaging $668.7 million per year. Locally funded capital expenditures represented 90.6% of all public-school capital spending in the state.

- The state legislature occasionally provides state funds for school facilities. Since 1949, the General Assembly has passed one facility appropriation bill and five state school bonds. The legislature approved the last statewide facilities bond in 1996. Since 2000, the State of North Carolina has provided local schools with $1.5 billion in funds for school facilities.

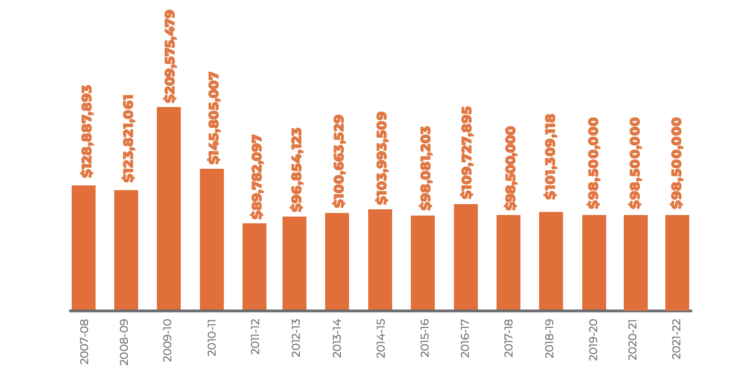

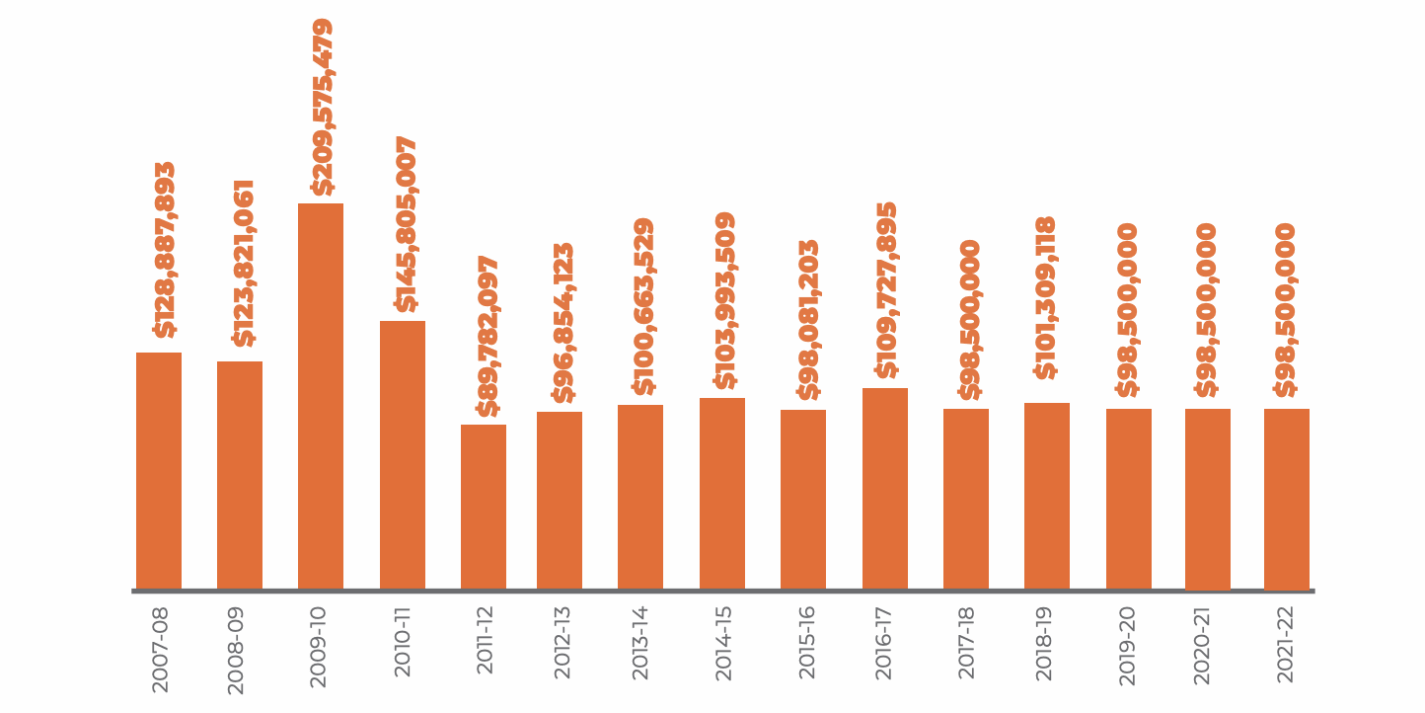

- State funding for local school districts is usually distributed via the Public-School Building Capital Fund (PSBCF). Three revenue sources have been used to fund PSBCF. From 1987 to 2009 a portion of corporate income-tax revenues was set aside for counties based on schools’ average daily membership (the ADM Fund). During that period, over $1.2 billion in tax revenue was collected. Since then, however, no allotments have been made to the ADM Fund. State lottery revenues and local option sales taxes are the other two sources of revenue. All counties levy two half-cent additions to the state sales tax: with 30% and 60% of the revenue, respectively, going to schools. Counties may also levy either an additional quarter-cent sales tax or a land transfer tax for funding school facilities.

- In 2017, the North Carolina General Assembly established the NeedsBased Public-School Capital Fund, which allocates North Carolina Education Lottery funds to low-wealth counties (Tier 1 or Tier 2 in the North Carolina Department of Commerce’s ranking of counties by economic distress) for new school construction.

- Over the past five years, the Needs-Based Public School Capital Fund has awarded $739 million to local school districts for new schools and replacement schools for economically distressed counties.

- Public charter schools do not receive capital funding from the state. Charters must use a portion of their operating funds to cover the cost of leasing a facility or repaying capital debt incurred through a private or nonprofit lender. In 2023 legislation was passed to allow local counties to contribute local tax revenue to help charter schools fund building needs.

Recommendations

1. Local governments should minimize the amount of debt incurred for school capital expenses.

A short-term need for additional classroom space or building repair must be weighed against the fiscal implications of assuming longterm capital debt. Planning for these obligations should include a thorough examination of current and projected revenue streams, student enrollment, population, and the county’s financial obligations. Local government officials can then determine whether the county’s tax base will support years of debt service payments. Doing so will also provide an opportunity to consider deferring the project(s) under consideration or building up a reserve fund.

2. Local governments should encourage school districts to use proven, cost-efficient solutions that would not burden county taxpayers but would enhance students’ educational opportunities.

Every year, county commissions dedicate millions of local taxpayer dollars for debt service to maintain unnecessarily costly school construction programs. Public/private partnerships, adaptive-re-use buildings, ninth-grade centers, satellite campuses, and virtual schools allow school districts to increase school building capacity faster and more cheaply than conventional school construction and renovation methods permit.

3. Revamp How School Construction Needs Are Assessed.

Currently, North Carolina statutes require local school boards to submit long-range plans to the State Board of Education every five years. Under the current plan, North Carolina public schools have $12.7 billion in planned new construction, addition, and renovations. With increased interest and growth in charter, private, and home schools, demographic changes, and an increasingly competitive environment for public investment, however, North Carolina should begin a full evaluation of its Five-Year K-12 Facility Needs Report to ensure the process can deliver timely, reliable recommendations and estimates that are cost-effective and responsive to public needs.

Public School Building Capital Fund: Lottery Revenue

Source: N.C. Department of Public Instruction

Sources of Funding for Education Facilities

| Fiscal Year | State Funds | Federal Funds | Local Funds | Total |

|---|---|---|---|---|

| 1999-00 | 518506820 | 8272720 | 627673264 | 1154452804 |

| 2000-01 | 371109242 | 789866134 | 1160975376 | |

| 2001-02 | 170257261 | 517911 | 842184297 | 1012959469 |

| 2002-03 | 41949345 | 9697902 | 782630041 | 834277288 |

| 2003-04 | 46210952 | 9528857 | 752716127 | 808455936 |

| 2004-05 | 21169420 | 3690000 | 699746058 | 724605478 |

| 2005-06 | 13842620 | 1790866 | 1003523533 | 1019157019 |

| 2006-07 | 21216361 | 743931 | 1170080840 | 1192041132 |

| 2007-08 | 18024915 | 212220 | 939450137 | 957687272 |

| 2008-09 | 12741320 | 139932 | 1266076911 | 1278958164 |

| 2009-10 | 13211971 | 2370296 | 415228020 | 430810287 |

| 2010-11 | 15124664 | 3810633 | 381005150 | 399940447 |

| 2011-12 | 8709622 | 12880229 | 330098767 | 351688618 |

| 2012-13 | 23736874 | 7449196 | 313077437 | 344263507 |

| 2013-14 | 8873255 | 43251 | 273651671 | 282568177 |

| 2014-15 | 11780490 | 380063582 | 391844072 | |

| 2015-16 | 14860996 | 524878167 | 539739163 | |

| 2016-17 | 34350149 | 729937634 | 764287783 | |

| 2017-18 | 23997621 | 2905316 | 664272950 | 691175887 |

| 2018-19 | 49522076 | 750638 | 644225456 | 694498170 |

| 2019-20 | 30802421 | 1383773 | 619429337 | 651615531 |

| 2020-21 | 25051964 | 2900004 | 600232048 | 628184013 |

| 2021-22 | 13683420 | 1476165 | 630081167 | 645240752 |

| Total | 1508733779 | 70563837 | 15380128728 | 16959426345 |

Source: N.C. Department of Public Instruction