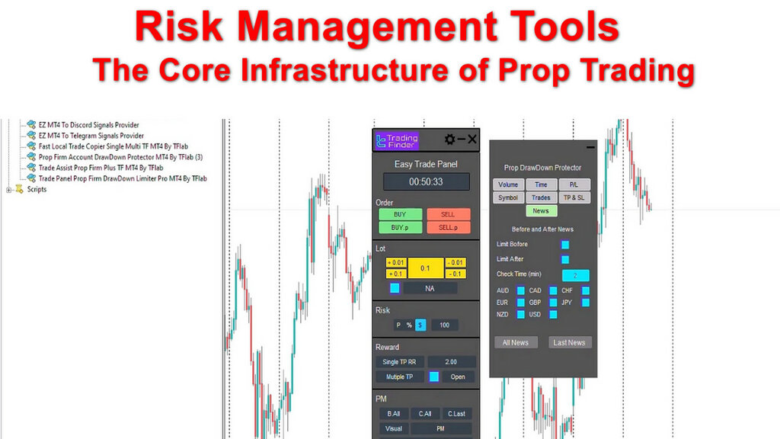

Prop trading in 2026 has evolved into a highly controlled and rule-driven environment. Modern proprietary firms rely on automated evaluation systems that track equity, drawdown, exposure, and timing with precision.

These expert advisors automate critical trading functions like position sizing, stop-loss logic, risk thresholds, and time restrictions. Whether you’re a prop firm candidate or an independent trader seeking more consistent performance, risk management tools are essential for eliminating emotional errors and boosting discipline.

Risk management tools have become the backbone of serious prop trading. They enforce discipline mechanically, eliminate emotional errors, and align trader behavior with firm-level rules.

Alt: Risk Management Tools

Caption: Use Risk Management Tools to eliminate emotional errors

Why Risk Management Now Outweighs Strategy

Many traders still believe that better entries or smarter indicators are the key to passing funded challenges. In practice, most failures occur not because a strategy stops working, but because risk spirals out of control. Overtrading, revenge trading, oversized positions, and ignoring daily limits are the real account killers.

Prop firms are not designed to reward aggressive behavior. Their rules are engineered to expose human weakness. Daily drawdown caps, equity-based loss rules, profit ceilings, and time restrictions leave no room for improvisation.

Risk management tools exist to solve this exact problem. They do not analyze price or predict direction. Instead, they act as an enforcement layer, ensuring that no action taken by the trader violates predefined limits. This separation between strategy and risk is what allows traders to remain consistent under pressure.

The Role of Trade Manager EAs in Modern Prop Trading

Trade manager expert advisors have evolved into highly specialized tools. Early versions handled basic tasks like lot size calculation or trailing stops.

Today’s solutions monitor entire trading sessions, enforce account-level rules, block trades during restricted conditions, and shut down execution automatically when limits are reached.

In 2026, these tools will no longer be considered optional. They are structural components of a professional trading setup, especially for traders operating under evaluation models.

Below are several high-impact Risk Management Tools that are widely used by disciplined prop traders.

Forex Trade Management Expert: Discipline Without Losing Control

The Forex Trade Management Expert is designed for traders who want strict risk enforcement without giving up manual execution. It does not place trades automatically. Instead, it supervises trading activity and blocks actions that would violate predefined rules.

This approach is especially valuable in prop firm environments, where traders are evaluated not just on results, but on how those results are achieved.

Core Capabilities

One of the tool’s strongest features is drawdown enforcement. Traders can define both daily and overall loss limits. Once either threshold is reached, trading is automatically suspended, preventing further exposure and eliminating the risk of emotional recovery attempts.

Profit and loss thresholds can also be defined. When a profit target is reached, the system can halt trading for the day, preserving gains rather than risking them unnecessarily.

Additional features include a built-in news filter to block trades during high-impact economic releases, trade frequency controls to prevent overtrading, and automated position sizing based on account balance or percentage risk.

This tool is particularly popular among traders who follow structured methodologies and want a non-intrusive system that protects them from their own impulses.

Equity PropTector: Account-Level Risk Enforcement in Real Time

Equity PropTector is a dedicated risk-only expert advisor that focuses entirely on capital protection. It does not interact with trade entries or exits directly. Instead, it monitors account metrics continuously and enforces strict boundaries at the equity level.

This makes it ideal for traders who already have a defined execution process but want an independent system overseeing compliance.

Key Risk Controls

The tool allows traders to set maximum daily loss, overall drawdown, and profit limits using either percentages or fixed monetary values. These limits reset automatically based on daily cycles, ensuring consistent enforcement across trading sessions.

Time-based controls allow trading to be restricted by day or hour. Traders can block execution during low-liquidity periods, overnight sessions, or any timeframe that historically increases risk.

Equity PropTector also includes trade count limits, preventing excessive trade frequency, a common cause of evaluation failure. When a rule is breached, trading is immediately blocked, protecting the account from further damage.

Alt: Equity PropTector

Caption: Equity PropTector focuses entirely on capital protection

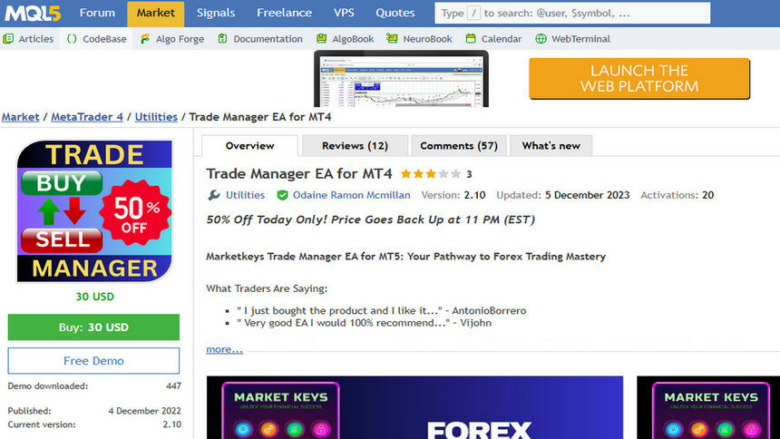

MT4 Trade Manager EA: Practical Risk Execution for Manual Traders

Not all Risk Management Tools need to be complex to be effective. The MT4 Trade Manager EA focuses on execution-level risk handling and is widely used by discretionary traders who want efficiency and structure without automation.

Its strength lies in integrating multiple risk and execution functions into a single, intuitive interface.

Execution-Focused Features

The EA calculates position sizes automatically based on predefined risk parameters, removing the need for manual calculations. This ensures consistent exposure across trades, regardless of market conditions or account size.

Trailing stops and break-even logic can be automated based on profit progression, allowing traders to lock in gains systematically. Partial close functionality enables scaling out of positions to improve risk-reward efficiency.

The tool also supports time-based trade management, allowing positions to be closed after a specified duration. This is particularly useful for avoiding news-related volatility or managing session-based strategies.

Alt: MT4 Trade Manager EA

Caption: MT4 Trade Manager EA calculates position sizes sutomatically

Why Risk Management Tools Decide Who Gets Funded

Data across the trading industry consistently shows that the majority of account failures are caused by poor risk control rather than flawed strategies. This is even more pronounced in prop firm environments, where strict rules are enforced without flexibility.

Risk Management Tools solve several critical problems simultaneously:

- They eliminate emotional decision-making during losing streaks;

- They enforce drawdown and exposure limits mechanically;

- They reduce cognitive load, allowing traders to focus on execution;

· They align trader behavior with evaluation metrics.

Final Thoughts

In 2026, prop trading is no longer about taking bold risks or chasing high win rates. It is about consistency, restraint, and rule compliance. The traders who succeed are not necessarily the most aggressive or creative, but the most disciplined.

Risk management tools are the infrastructure that makes this discipline possible. Tools like Forex Trade Management Expert, Equity PropTector, and MT4 Trade Manager EA do not promise profits. What they offer is far more valuable: protection from catastrophic mistakes.

For any trader serious about passing challenges, preserving capital, and building long-term consistency, structured risk management is not optional. It is the foundation upon which every sustainable trading career is built.

FAQ

1. What are Risk Management Tools in prop trading?

Risk Management Tools are expert advisors that enforce drawdown limits, position sizing, and trading rules automatically. They help traders stay compliant with prop firm requirements and avoid emotional mistakes.

2. Why are Risk Management Tools more important than strategy in 2026?

Most prop traders fail due to poor risk control, not bad entries or strategies.

These tools prevent overtrading, oversized positions, and rule violations that lead to instant failure.

3. Do Risk Management Tools place trades automatically?

Most tools do not place trades or predict the market.

They act as an enforcement layer, supervising execution and blocking actions that break predefined rules.

4. How do Trade Manager EAs help with prop firm challenges?

They monitor equity, drawdown, trade frequency, and timing in real time.

If limits are reached, they stop trading automatically to protect the account from disqualification.

5. Can manual traders benefit from Risk Management Tools?

Yes, they are especially useful for manual traders who want discipline without automation.

These tools handle calculations and limits, allowing traders to focus solely on execution.