The Tax Foundation released a new study today analyzing the fiscal impacts of a proposed income tax. I want to highlight a few of their findings if that proposal was to pass this legislative session.

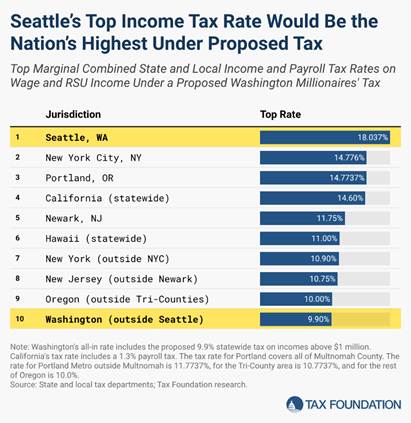

1. Seattle would have the highest combined tax rate in the country.

The 9.9% state income tax proposal would stack on top of existing Seattle payroll taxes (the JumpStart tax and the Social Housing tax) plus the state’s WA Cares tax. That would lead to a total combined tax rate of 18.037%. That’s 22% higher than the next closest jurisdiction, New York City.

With federal taxes included, high income Seattleites would be paying an astronomical tax rate of 58%.

Source: Tax Foundation

2. The governor’s income tax proposal would hit tech workers and small business owners hardest, who are the backbone of our state economy.

The Tax Foundation study looked at high income earners – many of whom are tech workers with stock – and found that about 28% of their income comes from wages and restricted stock units (RSU’s). Currently, RSUs are not taxed under capital gains, but they would be under the proposed income tax.

Another 18.7% is small business income. Washington has 672,472 small businesses employing 1.4 million people. They already pay our B&O gross receipts tax. Now they’d face a 9.9% income tax on top of that.

3. Every state that started with an income tax on just high earners eventually expanded it to everyone.

Governor Ferguson mentioned that he would support a constitutional amendment to lock in the $1 million threshold, but he hasn’t made that a condition of his support, nor have democratic leaders given any indication that the tax would stay at a $1 million threshold.

This would make Washington, and Seattle particularly, an extreme outlier nationally. It would likely shrink the tech sector in the Puget Sound region, hollowing out the economy of the largest city in our region.

Even Senate Majority Leader Jamie Pedersen admits Democrats have made mistakes when proposing outlier tax rates. At the 2026 Legislative Session Preview on January 9 (TVW), he said:

“When you think about actual behavior that’s driven by a tax system, what may lead to real changes in terms of people choices about where to reside is where you become an outlier state…we made a mistake this last year when we made a top marginal rate for the estate tax that is so much higher than the rate in any other state…I have heard that there are people who, because of that, are making a decision to change their residence.”

Democrats know high outlier tax rates drive people out. Now they want to give Seattle the highest marginal tax rate in America.

Read the full Tax Foundation analysis here: taxfoundation.org/blog/washington-income-tax-proposal-millionaires-tax/