Introduction

In 2017, state government owned nearly 118 million square feet of space across 12,000 buildings worth $25.6 billion. The state budget includes more than $700 million per year to pay the principal and interest on money it borrowed to build and maintain these facilities.

The 2017 budget bill, passed over Gov. Roy Cooper’s veto, created the State Capital and Infrastructure Fund (SCIF), a pay-as-you-go fund that sets aside 4% of annual state tax revenue and one-fourth of any year-end unreserved cash balance for construction, repairs, and debt payments. As the state pays off existing debt, more money becomes available to build new facilities, maintain what already exists, and address other pressing liabilities such as benefit costs related to retired state employees.

The 2022 budget, however, changed the General Fund statutory contribution to the SCIF from 4% of General Fund revenue to a set amount ranging from $1.4 billion to $1.1 billion each year from fiscal year 2023-24 to fiscal year 2025-26. The contribution will grow by 3.5% each year after fiscal year 2025-26.

Advocates of using the pay-as-you-go method of financing capital projects via SCIF point out that it saves taxpayers millions of dollars in avoided interest payments that would be owed if the capital projects were debt financed. Paying for capital projects in real time also frees up future budgets, which will be unburdened by debt payments.

Key Facts

- According to the most recent data available, state government has $25.6 billion in facilities with a backlog of roughly $4 billion in repairs because of past neglect. A general rule of thumb suggests setting aside 2.5% of a property’s value for maintenance and renovation, which would total $640 million per year in North Carolina’s case.

- Principal and interest payments on state debt supported by the General Fund amounted to roughly $650 million in the 2022-23 budget, down from $728 million five years prior.

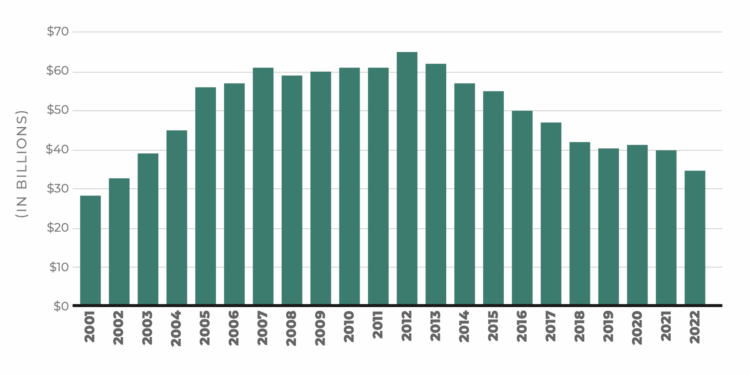

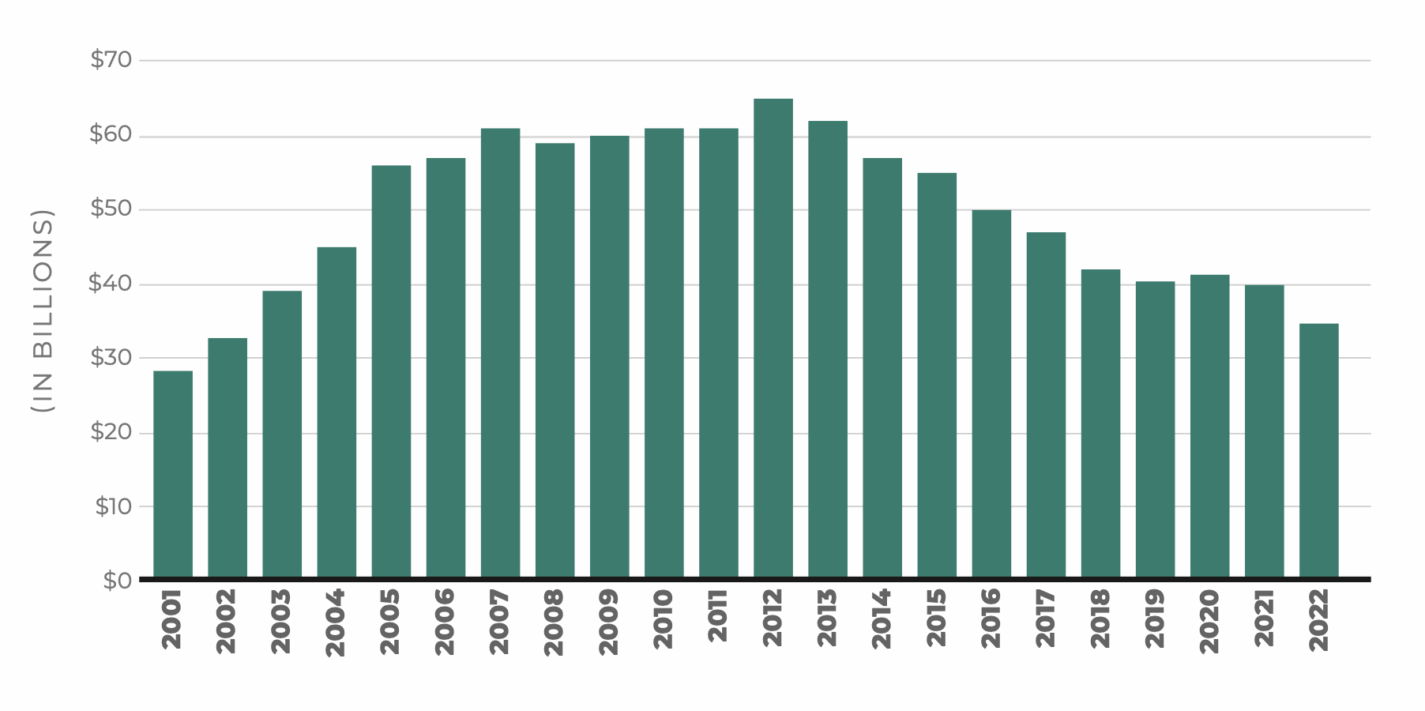

- Liberal leadership ballooned tax-supported General Fund state debt from $2.83 billion in 2001 to $6.5 billion in 2012, a whopping 130% increase. Conservative leadership elected in 2010 began to reverse that trend, dropping the debt to $3.5 billion by 2022, a decrease of 46% in just over a decade.

- The State of North Carolina continues to maintain its AAA credit rating from the three primary credit rating agencies. This is the highest possible rating, and currently, just 13 other states enjoy the same rating from all three agencies. This rating means that North Carolina when it chooses to do so can issue debt at the lowest possible interest rates, thereby saving taxpayer dollars.

- The recommended target for tax-supported debt service payments by state government is 4% of General Fund revenues. Thanks to prudent, conservative fiscal management over the past decade, the state is well below that target.

Recommendations

- Continue to use the State Capital and Infrastructure Fund (SCIF) to pay for construction, repairs, and renovations of state property.

Paying for capital from current revenue ensures that construction, repairs, and renovation happen on schedule and provides more flexibility in the future instead of tying up hundreds of millions of dollars in debt payments. - Consolidate state-owned facilities.

Sell what is not needed, improve what is left, and consider ways to use space more effectively in prime locations for retail. - As debt is paid down, use more money for unfunded liabilities tied to retired state employees.

According to the 2023 North Carolina Comprehensive Annual Financial Report, the unfunded liability for the Teachers’ and State Employees’ Retirement pension system (TSERS) is $14.8 billion.The unfunded liability for retiree health benefits, the largest portion of other post-employment benefits, is $23.7 billion. These figures represent the amount of benefits that have been promised to current and future state retirees over the next 30 years for which no funding has been set aside.

Tax Supported General Fund Debt

Source: North Carolina state treasurer’s office; annual debt affordability study, years 2021, 2019, 2014, 2009 and 2006. Available online at: https://www.nctreasurer.com/office-state-treasurer/transparency