Overwhelmingly popular new mandate spurs action from nonprofits

Editor’s note: Fourteen years ago, the Badger Institute (then known as WPRI) issued a paper by Scott Niederjohn calling on the State of Wisconsin to require that all high school students take a course in economics and personal finance before graduating. Only 19 percent of high school kids at that time even knew the definition of inflation, and there’s little indication today’s students are much better versed. While it’s disappointing that not all Wisconsin high school students learn about market-oriented economics, the state has finally mandated financial literacy courses. Now, as Niederjohn suggests below, comes the hard part — implementation.

Finally.

Beginning with the class of 2028, all high school students in Wisconsin must complete at least one semester of personal financial literacy to earn a diploma — the much-needed result of Act 60, signed into law with overwhelming bipartisan support by Governor Tony Evers in December 2023.

The law — which proponents argued would help break cycles of generational poverty and reduce dependence on social safety nets — mandates that every student complete a course including information about everything from money management to saving and investing to risk management and insurance.

Nonprofits and institutions are bringing some Wisconsin educators up to speed on how to teach the subject: More than 225 teachers took part in training workshops this summer in Wisconsin. But there are more than 500 public high schools in Wisconsin and only two years before the class of 2028 begins its senior year.

Wisconsin already required that all districts teach its personal finance standards in the K-12 curriculum. They could do it however they wanted and were not asked to show how they did it — there was no stand-alone course requirement. The change is that now a stand-alone course is required at the high school level.

Some schools are starting with an advantage. About one-third of students attended schools offering elective personal finance courses, and districts such as Milwaukee Public Schools had already implemented semester-long programs voluntarily. The state, however, doesn’t keep a count of how many districts have implemented stand-alone programs.

Best practices for implementation

With the law in place, it’s up to Wisconsin schools to implement this requirement effectively. Drawing from research and the experiences of other states, several best practices stand out:

Invest in teacher training: A 2009 study found that fewer than 20 percent of teachers felt well-qualified to teach personal finance. Encouragingly, by 2020, 95 percent reported feeling confident or very confident.[1] However, ongoing training is crucial.

Engage students with active learning: Financial concepts can be abstract or intimidating. Lessons that use simulations, games, case studies and real-life scenarios boost engagement and retention.

Leverage community partnerships: Local banks, credit unions and nonprofits often provide guest speakers, financial tools, and classroom resources. These partnerships can bring real-world perspective — but schools should guard against undue commercial influence.

Measure outcomes: Research shows that financial literacy education can lead to better financial behaviors, such as increased savings, improved credit scores, and reduced reliance on high-interest loans. Ongoing assessment ensures the program remains impactful and allows for continuous improvement.[2]

Key financial literacy organizations supporting schools

Several national and state-level organizations provide resources and professional development:

- Council on Economic Education: Offers curriculum guides and teacher training.

- Foundation for Economic Education: Promotes free-market financial thinking and offers certification programs.

- Jump$tart Coalition: A national advocate that connects educators to vetted financial literacy materials.

- Junior Achievement: Offers hands-on programs in financial literacy, entrepreneurship and career readiness.

- Next Gen Personal Finance: Provides a comprehensive, no-cost curriculum and extensive teacher training opportunities.

Wisconsin’s path forward on Act 60 implementation

Although Act 60 did not provide dedicated funding, schools are not without support. The Wisconsin Department of Public Instruction has employed 13 regional fellows — one in each Cooperative Educational Service Agency district — to monitor over the next two years how each district is implementing Act 60 and to assist educators in meeting the law’s requirements.

Next Gen Personal Finance has awarded Wisconsin a $300,000 grant to help expand training and resources for educators.

Statewide activity is already underway. In the summers of 2024 and this year, Next Gen partnered with the Wisconsin Office of Financial Literacy, Economics Wisconsin, and Concordia University’s Free Enterprise Center to host weeklong professional development programs for teachers. These sessions serve as a model that can be scaled up across the state.

Why now? Trends driving financial literacy mandates

While the idea of teaching students how to manage money isn’t new, a convergence of economic and societal trends has elevated the issue.

Growing financial complexity: Navigating today’s financial world requires a level of understanding that previous generations didn’t need. Students will face complex financial products, digital banking platforms, and evolving technologies, all demanding more sophisticated decision-making.

Greater personal responsibility: Workers today are expected to plan for retirement, understand health care plans, and manage debt with little employer guidance. This shift has put more pressure on individuals to master financial concepts early in life.

The 2008 financial crisis: The global financial meltdown served as a cautionary tale about widespread financial illiteracy. Millions of Americans were approved for home loans even though the odds were strong that they could not afford to own a home. It fueled demand for stronger financial education to prevent similar future crises.

Engagement from communities and institutions: Businesses, nonprofits, and financial institutions now recognize the long-term benefits of a financially literate population. Their support has provided momentum and resources for curricular reform.

Economic consequences: Studies suggest that improved financial literacy reduces default rates on student loans and increases participation in retirement plans, leading to a more stable, self-reliant workforce.

These forces have made it clear: personal financial literacy is no longer optional — it is essential for navigating the modern economy.

Most states have responded to this urgency by incorporating financial literacy into academic standards. As of 2024, 48 states include personal finance in their academic benchmarks (only Alaska and California do not).[3] National organizations such as the Council on Economic Education and the Jump$tart Coalition have created comprehensive standards covering everything from budgeting to taxes.

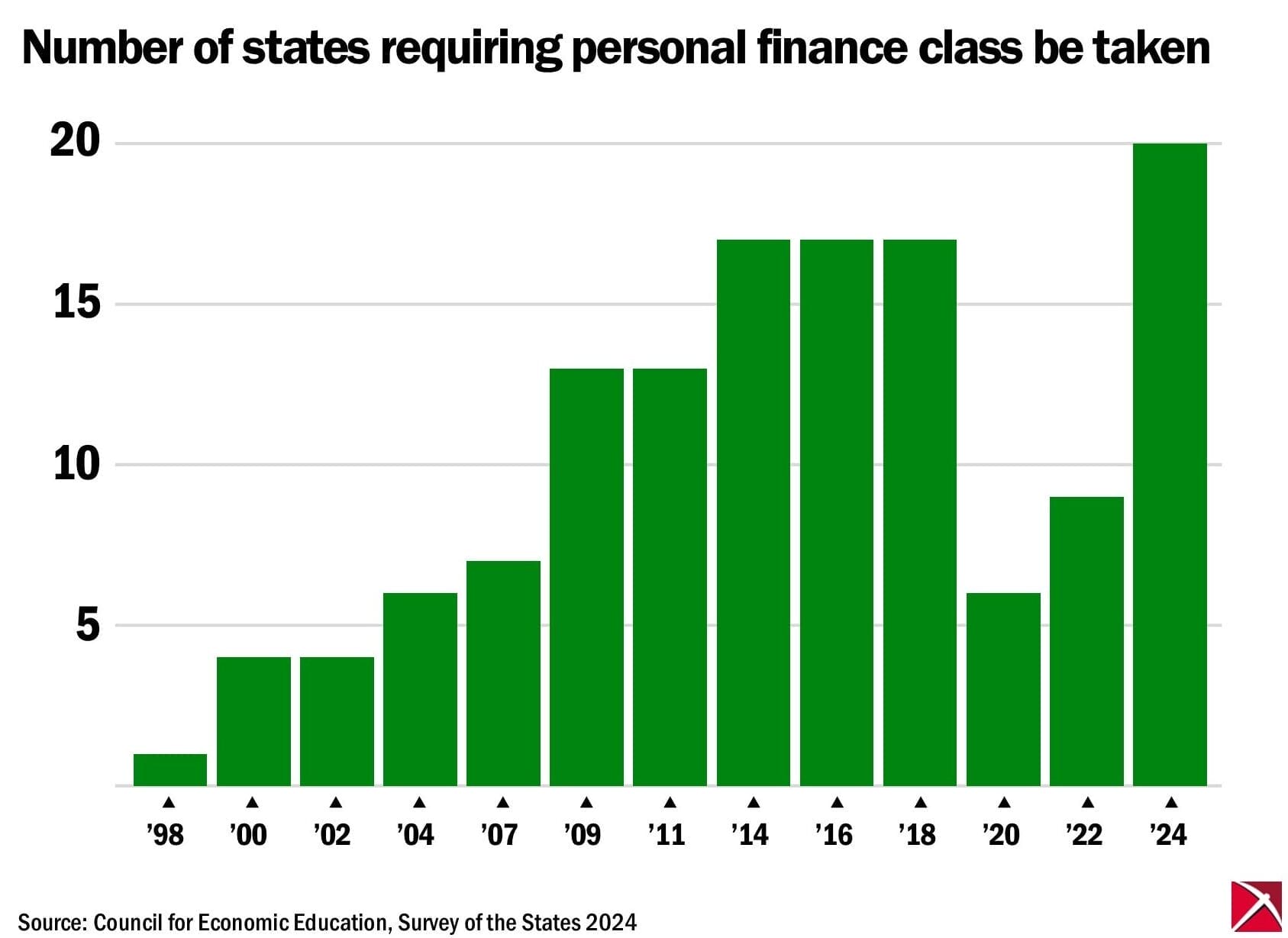

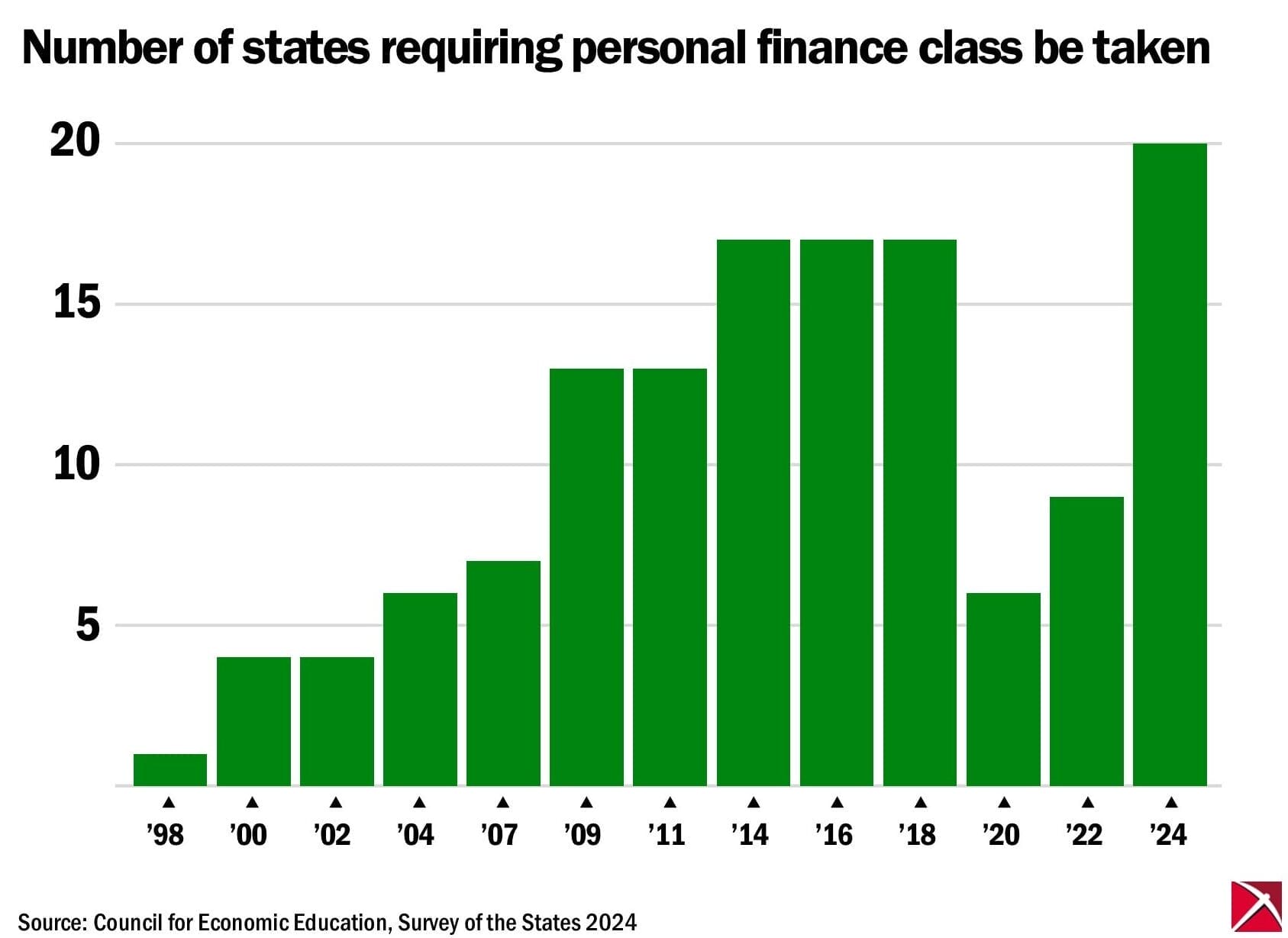

Twenty states now require a stand-alone financial literacy course for high school graduation. According to Next Gen Personal Finance, 26 states are either fully implementing or actively working toward such mandates.

The graph below illustrates the trajectory of adoption over time. Early adopters laid the groundwork in the early 2000s, but a significant surge began in 2020.

Just the beginning

Over the past quarter century, states have increasingly recognized the value of personal financial education. The growing complexity of financial life and the increased burden on individuals demand a more informed citizenry. Wisconsin’s new requirement is a meaningful step in that direction.

But passage of the law is just the beginning. As educators, policymakers, and communities work together to implement Act 60, they must remain committed to providing the resources and flexibility schools need to succeed. This is not just a curriculum shift — it is a long-term investment in Wisconsin’s economic health and civic strength.

Scott Niederjohn is a professor and the director of the Free Enterprise Center at Concordia University Wisconsin and dean of the Batterman School of Business, and he is a visiting fellow of the Badger Institute.

Any use or reproduction of Badger Institute articles or photographs requires prior written permission. To request permission to post articles on a website or print copies for distribution, contact Badger Institute Marketing Director Matt Erdman at matt@badgerinstitute.org.

Submit a comment

References

[1] Council for Economic Education, “Survey of the States,” 2009 and 2020 editions

[2] Urban et al., “State-Mandated Financial Education and the Credit Behavior of Young Adults,” Journal of Consumer Affairs, 2018

[3] Next Gen Personal Finance, “2024 State of Financial Education Report”