Nebraska’s Truth-in-Taxation season brings surprises each year, shining a light on local government tax increases. That’s because Nebraska’s Truth-in-Taxation law requires local governments to notify property owners of proposed tax increases as a prelude to public hearings about the tax proposals.

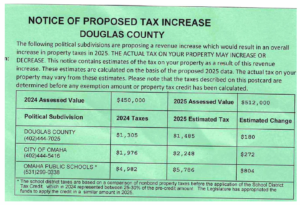

Residents of Omaha were hit with another set of unsustainable tax increases in 2025, as evidenced below by the Notice of Proposed Tax Increase for a Douglas County home. Total assessed value in Douglas County and Omaha School District rose by 5.25% for the year. OPS also increased its tax rate, resulting in a total property tax increase of 7.3%. By comparison, consumer prices have increased 2.9% year-over-year and wages are up 3.6% year-over-year, according to the Bureau of Labor Statistics.

Nebraska’s “soft” tax caps simply are not working for homeowners. For example, one home’s assessed value rose 13.8%, and its taxes are set to increase an estimated 15.2% in just one year.

The home’s assessed value increased from $450,000 to $512,000 year-over-year, for a 13.8% bump in valuation. Assessment increases are regularly used as cover for massive tax increases without raising rates, as occurred with Douglas County and the City of Omaha. The estimated tax increase for the home went up in lockstep with the valuation increase for these two jurisdictions. Omaha Public Schools increased its tax rate, resulting in a 16.1% tax increase on this home, capturing revenue beyond the valuation increase.

| Political Subdivision | 2024 Taxes | 2025 Estimated Tax | Tax Increase | Percent Tax Increase |

| Douglas County | $ 1,305 | $ 1,485 | $ 180 | 13.8% |

| City of Omaha | $ 1,976 | $ 2,248 | $ 272 | 13.8% |

| Omaha Public Schools | $ 4,982 | $ 5,786 | $ 804 | 16.1% |

| Total | $ 8,263 | $ 9,519 | $ 1,256 | 15.2% |

In total, taxes will go up an estimated 15.2% in one year for the homeowner. While this is an outsized increase for this Omaha home, driven by an assessment hike more than 2.5 times the citywide average.

Nonetheless, property taxes are increasing faster than wages and faster than inflation because local government spending continues to grow without meaningful restraint.

Nebraska’s property tax cap laws must be revisited and tightened because they are not delivering for homeowners. K-12 school districts have received significant state aid under Governor Pillen, yet OPS still increased its property taxes by over 7% with little policy hindrance. Property tax increases above 5% were easily achieved in both Douglas County and the City of Omaha. Voters should have a direct say in such significant increases via referendum.

Nebraska should consolidate and tighten its caps. Under current law, public safety expenditures are exempt from tax caps, and taxes are allowed to grow in-line with a national measure of government spending increases. Government spending consistently outpaces inflation and wages, and so is an inappropriate restraint.

All local government spending should be subject to tax caps, and governments should prioritize where they want to grow spending under universal caps. Tax growth should be restricted to roughly the rate of inflation unless voters approve a larger increase. No longer should local officials be empowered to exceed tax caps – that power should rest solely with the people who pay the taxes.