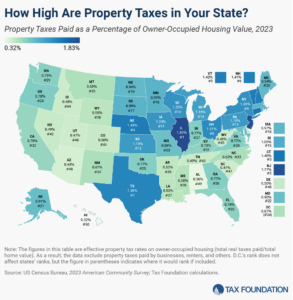

Nebraska’s property taxes have risen to fourth highest in the United States, according to a 2025 study from the Tax Foundation using 2023 tax data. Illinois (1.83%) has the highest taxes as a share of home value, followed closely by New Jersey (1.77%). Following New Jersey is Connecticut (1.48%) which is only slightly higher than Nebraska (1.43%).

Nebraska’s #4 ranking is the highest in its history amid ongoing efforts to lower property taxes. Notably, Nebraska appears to be doing worse than other states in preventing rising property appraisals from translating into rising property taxes.

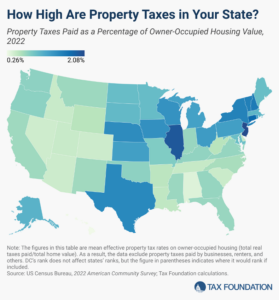

Nebraska previously ranked eighth highest for property taxes based on 2022 tax data, with a rate of 1.44%.

Nebraska surged into the highest tax tier in the tax burden rankings despite its effective tax rate barely budging from one year to the next. Property values were surging from year to year, which accounts for the lower tax rates across states. Local governments could collect the same revenues with lower tax rates because valuations were skyrocketing.

| 2022 Property Tax Rankings | 2023 Property Tax Rankings | |||||

| 1 | New Jersey | 2.08% | 1 | Illinois | 1.83% | |

| 2 | Illinois | 1.95% | 2 | New Jersey | 1.77% | |

| 3 | Connecticut | 1.78% | 3 | Connecticut | 1.48% | |

| 4 | New Hampshire | 1.61% | 4 | Nebraska | 1.43% | |

| 5 | Vermont | 1.56% | 5 | Vermont | 1.42% | |

| 6 | New York | 1.54% | 6 | New Hampshire | 1.41% | |

| 7 | Texas | 1.47% | 7 | Texas | 1.36% | |

| 8 | Nebraska | 1.44% | 8 | Ohio | 1.31% | |

| 9 | Iowa | 1.40% | 9 | New York | 1.26% | |

| 10 | Wisconsin | 1.38% | 10 | Wisconsin | 1.25% | |

The difference seems to be that Nebraska is uniquely challenged in preventing higher valuations from translating into higher taxes. Indeed, in the property tax surge Platte profiled last week, a Douglas County home’s property taxes went up 15.2% in one year because the home’s higher valuation was simply captured with the same tax rate. The solution to higher valuations is to automatically knock the rate down to a revenue-neutral rate whenever a government subdivision’s valuations increase.

Nebraska’s local governments also capture tax increases by leveraging credits that are applied to tax bills. They know they can let taxes run high because state lawmakers provide resources to offset those higher taxes. State lawmakers can eliminate this “third-party payer problem” by directly lowering property tax levies and capping tax levies going forward.

A broader policy toolkit should be enacted to arrest Nebraska’s surge in the property tax burden rankings, otherwise the future could have Nebraska break into the top three.

- Automatic revenue-neutral rate rollback when valuations surge, like in LB 575

- Send school district property tax credits directly to school directs and require a direct dollar-for-dollar reduction into property taxes.

- Impose a hard cap on tax levies for all political subdivisions. Allow levies to rise only with inflation as calculated by the consumer price index (CPI). Additional increases require voter approval.

- Move the Truth-in-Taxation transparency process up by two months, as in LB 575, to ensure to process is conducted before local budgets are set.

- Requires the Truth-in-Taxation process to be conducted for the first dollar of increase in the tax levy, as is done in Utah and Kansas.

Significant lawmaker attention and state resources have been poured into property tax relief and tax cap reform. That work must be revisited considering Nebraska’s surge in the property tax burden rankings. Lawmakers should impose simpler, tighter tax caps and tax credit dollars should be deployed to directly reduce tax levies.