The city of Austin wants to raise your taxes. Again. And in a big way.

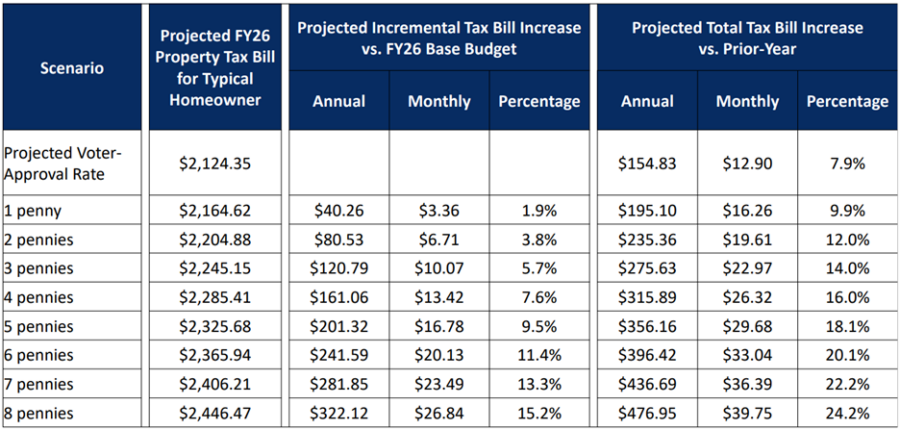

On Tuesday, city councilmembers explored several tax increase proposals, most of which would require voter-approval in November. The options ranged from raising taxes only up to the 3.5% trigger, which would add $154.83 to the average homeowner’s tax bill, to a voter-approval tax rate election (VATRE) track that could increase the city’s maintenance and operations (M&O) rate by as much as 8-cents. Assuming Austin voters approved the massive rate hike, it would result in the average homeowner paying an additional $476.95 per year.

And, of course, there were plenty of options in between.

Seeking to justify the city’s possible VATRE, one city councilmember offered a well-worn specious argument, claiming:

“If Austin is going to stay a progressive, democratic, environmentally conscious, and socially just community, we likely need to increase revenue through a tax rate election. We know this is not an easy decision for Austin voters, but a tax increase may be needed so the City can maintain the quality of our programs and services.”

Oddly, it was only a few months ago that this same official lamented the city’s ongoing affordability crisis, saying: “I heard over and over again that our nurses and teachers and electrical workers—the people who really power Austin and make it this wonderful place—can’t afford to live in the city.”

At this point, it remains unclear how a tax increase of between $155 and $477 per year will make it easier to afford living in Austin, but perhaps city officials will explain things more clearly soon.

Another peculiar argument was offered up by a different city councilmember who attempted to garner sympathy for the government’s position by appealing to everyday concerns. Presumably with a straight face, the official said:

“We talked about it today. We don’t even have the personnel to clean the bathrooms every day.”

Now, without knowing anything about the city’s finances, this remark might be persuasive. After all, everyone enjoys a clean bathroom.

But, of course, we know a thing or two about Austin’s $6.3 billion budget.

Without offering an extended critique, it is farcical to suggest that the city’s $6+ billion budget—which amounts to almost $6,500 in spending per capita—is so lean, so efficient, and so strapped that it cannot support hiring one or more cleaning professionals. Especially when the city’s a host of questionable spending increases, like $800,000 more for its Equity and Inclusion office, $900,000 more for taxpayer-funded lobbying, $700,000 more for climate action and resilience, and much, much more.

Nothing about the situation today supports a massive tax increase.

Democracy™ doesn’t need it. Affordability won’t be helped by it. And the facts on the ground don’t support it.

Instead of raising taxes, Austin officials ought to be considering how to reduce the cost of city government. This is especially urgent considering that the average Travis County resident’s tax bill grew to $10,356 in FY 2025. The last thing homeowners need is to fork over even more money to Austin governments.

So let’s stop talking about VATREs Austin and get serious about tax policy. Just about every taxpayer in this town is eager for a new direction.