During the pandemic, property values surged across North Carolina, generating frustration among residents whose property tax bills have risen faster than their incomes.

In response, the General Assembly established the House Select Committee on Property Tax Reduction and Reform to study rising property tax burdens. The committee’s charge includes considering statutory or constitutional reforms that would limit the extent to which local governments can increase property taxes.

Property taxes

Property taxes are a significant source of revenue for local governments in North Carolina. In fiscal year (FY) 2023–24, property taxes accounted for 44 percent of county-level revenue and 22 percent of municipal-level revenue. These revenues support core local services, including education and public safety.

Property tax rates are set locally and vary widely across the state. In FY 2024–25, county property tax rates ranged from 0.27 percent to 0.99 percent of assessed value. While local governments have discretion in setting rates, North Carolina law imposes a statutory cap of 1.5 percent on each taxing unit’s property tax rate.

Property tax revenue is determined by a simple formula:

Property Tax Revenue = Property Tax Base X Property Tax Rate

Home value trends

According to the Zillow Home Value Index, from 2015 to 2024, the typical home value in North Carolina rose from just under $162,000 to more than $330,000 — an increase of 104 percent. Meanwhile, over the same period, home values nationwide increased by only 87 percent. This divergence reflects strong migration to North Carolina, which increased housing demand relative to national trends.

In particular, annual growth soared in 2021 and 2022, when North Carolina home prices increased by approximately 18 percent and 19 percent, respectively.

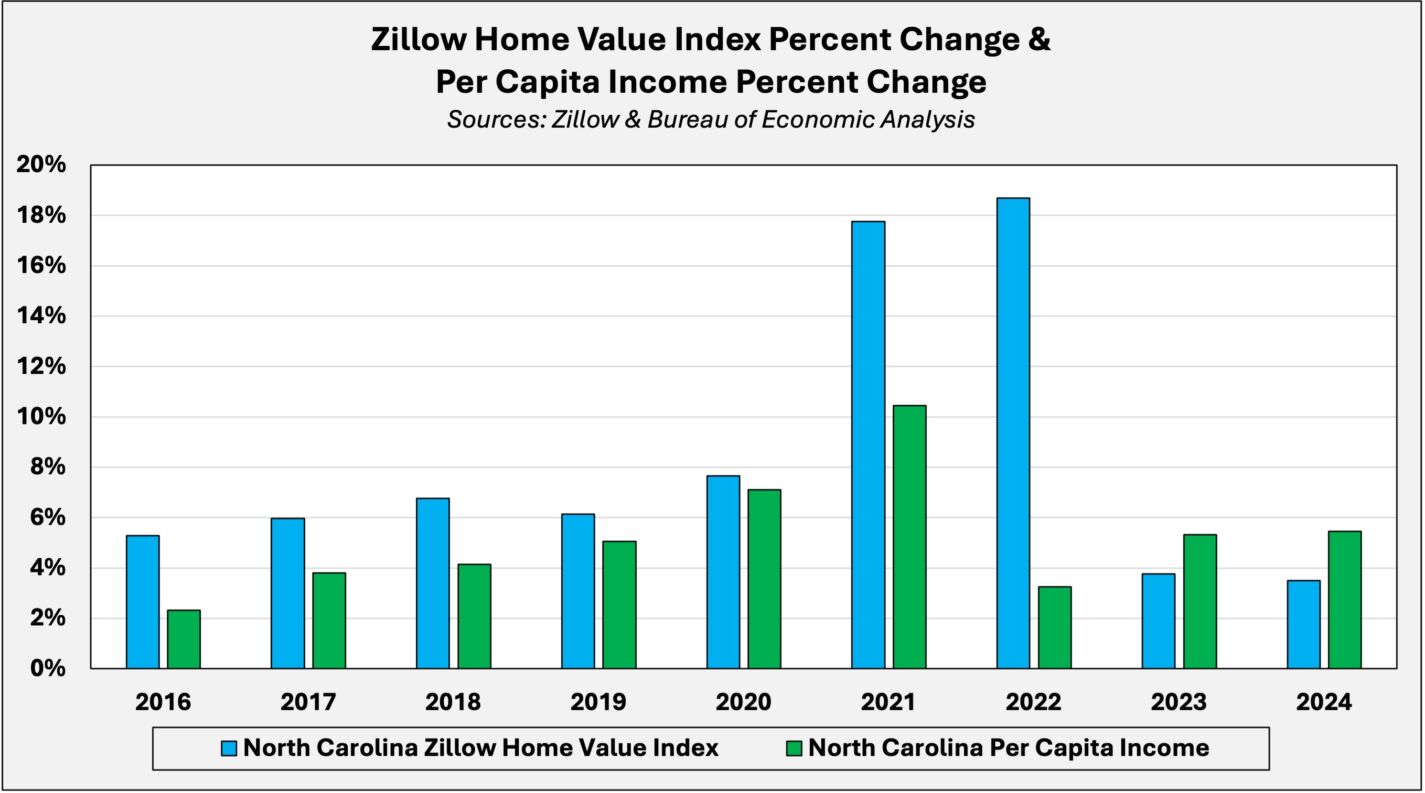

Comparing home value growth with per capita income growth highlights the structural pressure behind rising property tax burdens. From 2015 to 2024, the cumulative growth in per capita income in North Carolina was 58 percent, compared to the 104 percent increase in the value of a typical home. As a result, growth in property values — which determines the property tax base — has exceeded growth in the incomes used to pay property tax bills.

The gap between home value growth and per capita income growth widened most dramatically in 2022, when home prices continued to surge while income growth slowed.

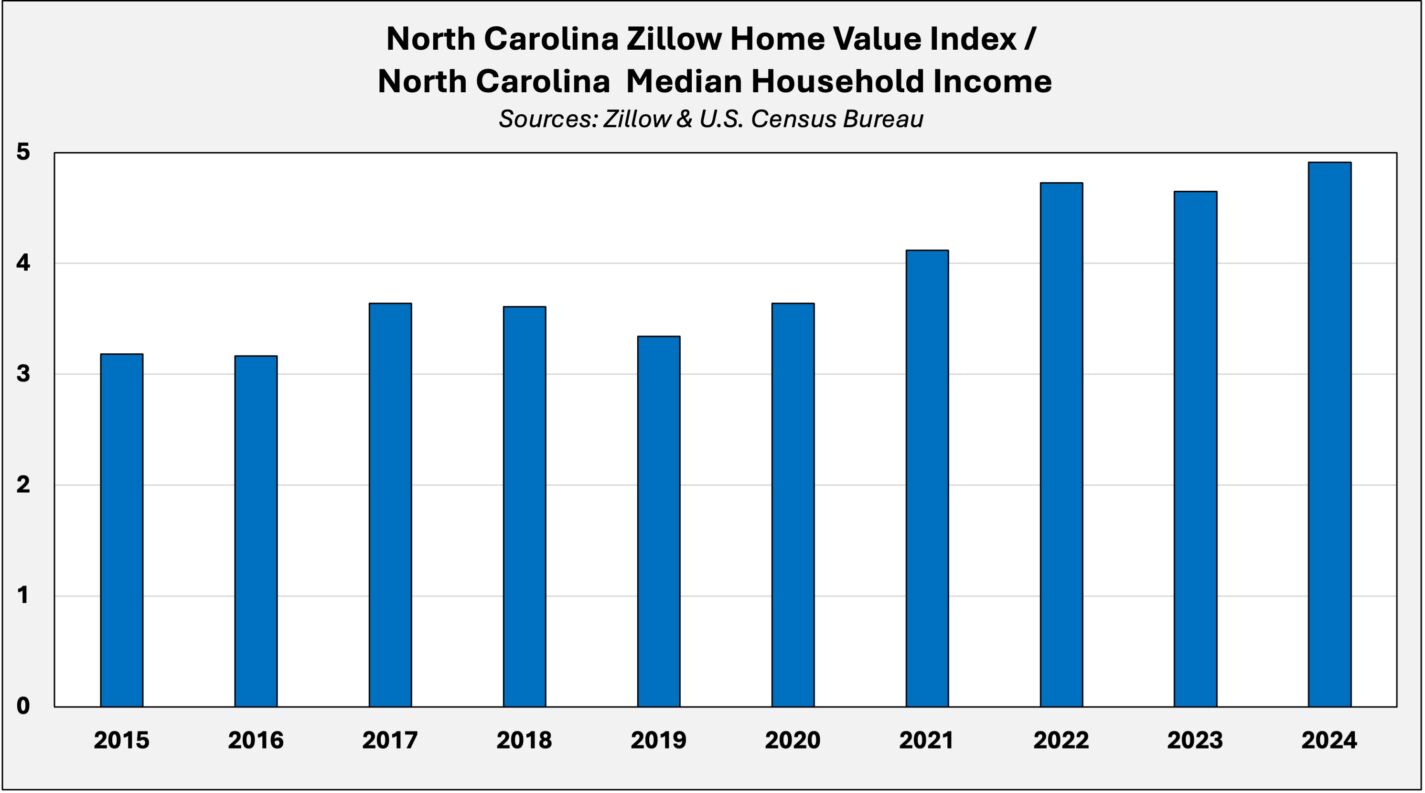

Looking beyond growth rates, the gap between home values and incomes becomes even clearer when viewed in ratios. From 2015 to 2024, home values increased from 3.2 times the state’s median household income to 4.9 times. This jump helps explain why property taxes are increasingly felt as burdensome by households, particularly long-time homeowners and those on fixed incomes.

Property tax revenue

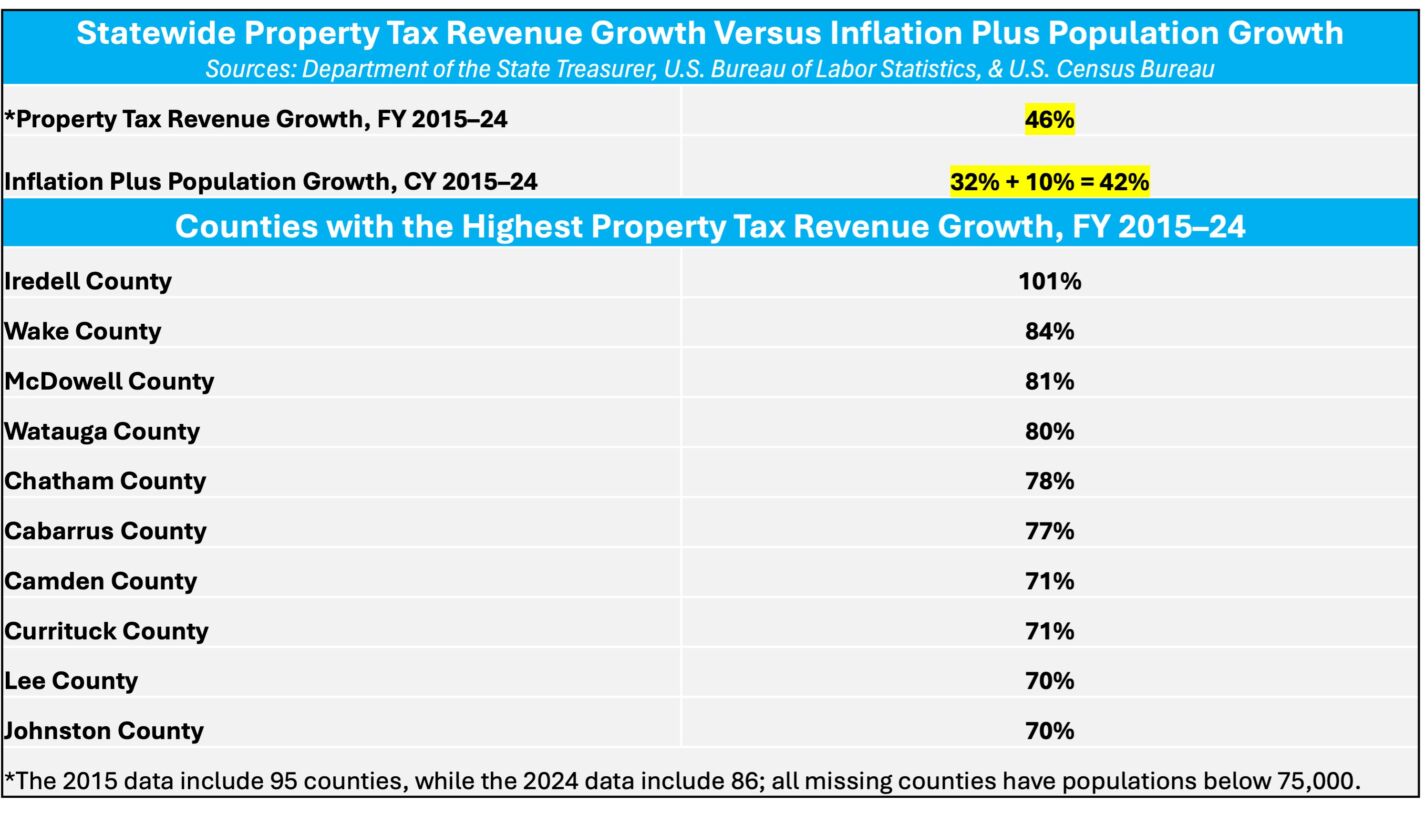

According to data provided by the Department of the State Treasurer, aggregate county property tax revenue increased from approximately $6.5 billion in FY 2015 to $9.6 billion in FY 2024, a 46 percent increase. Meanwhile, inflation plus population growth totaled 42 percent. This indicates that county property tax collections expanded in real per capita terms rather than merely keeping pace with higher costs and a larger population.

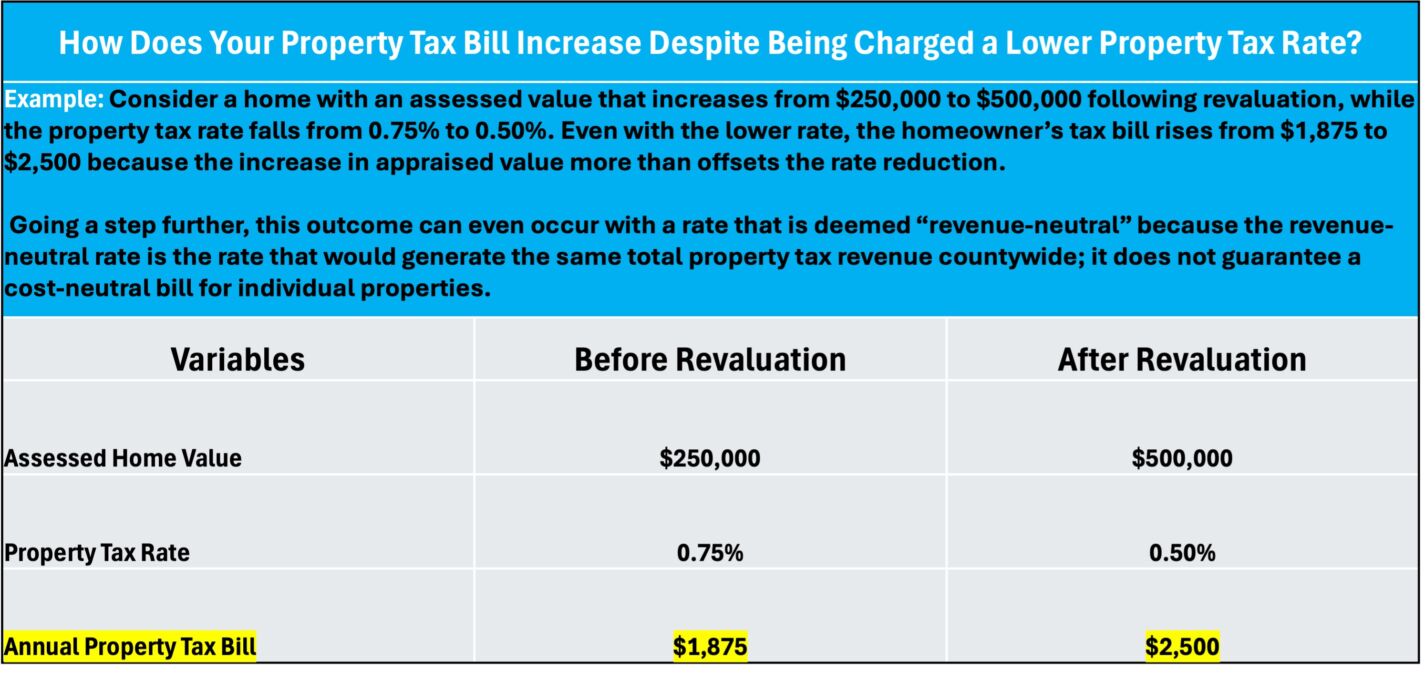

Before exploring policy options, it is crucial to note that over the past three years, 71 counties have conducted revaluations and all subsequently lowered their tax rates, highlighting the rate reductions as evidence of tax restraint. As the following example shows, however, lower rates do not necessarily translate into lower tax bills, which has contributed to confusion among taxpayers.

Policy alternatives

It is essential to acknowledge that the full repeal of the property tax is not a realistic option. Property taxes account for a significant portion of local government revenue; replacing them would necessitate substantial increases in other taxes, particularly sales taxes, that would be economically disruptive.

While all taxes reduce economic activity, the property tax is generally less economically distortive than alternatives. The policy question, therefore, is not whether to eliminate the property tax, but how to limit its growth and improve transparency.

It is also important to note that North Carolina already provides targeted property tax relief for certain vulnerable groups through homestead exemptions, most notably low-income seniors, which reduce taxable values for qualifying households.

The following are policy options available to policymakers that would directly limit the growth of property tax burdens:

- Rate limits cap the maximum property tax rate a local government may charge. However, because assessments can rise rapidly, tax bills may still increase faster than desired even when rates are held constant.

- Assessment limits restrict the annual growth of taxable property values, reducing the impact of sharp market-driven valuation increases. Local governments can still offset these limits by raising tax rates, which weakens the overall constraint on tax growth.

- Levy limits cap total property tax revenue growth, typically tying increases to inflation plus population growth. This approach provides the strongest protection against rapid tax increases by directly limiting the growth of property tax collections.

In addition to direct constraints on property taxes, there are the following alternatives:

- Revenue or spending limits cap overall local government revenue or expenditure growth, rather than focusing solely on property taxes. When done right, spending limits can restrain government growth and provide greater overall protection for taxpayers than reforms that only address property taxes.

- Truth-in-taxation requirements increase transparency by requiring local governments to make public announcements and hold public hearings before tax increases.

Closing thoughts

Home values have risen faster than incomes, and county property tax revenues have grown more rapidly than inflation plus population growth, resulting in tax burdens that exceed what would be required to maintain existing service levels.

As the committee moves forward, legislators should be careful not to shift the focus toward broader housing affordability debates. Moreover, policymakers should also recognize that constraints on local government spending can invite similar arguments for restraint at the state level, and justifiably so.

Within that context, policies such as a levy limit and truth-in-taxation requirements offer reasonable ways to curtail property tax hikes and enhance transparency without undermining local governments’ ability to fund core services.