“Instead of intervening in the marketplace, policymakers wanting to address affordability should focus on getting government out of the way by restraining spending that drives inflation and cutting costly regulations that push prices higher.”

The following has been adapted from an excerpt of the Frontier Weekly Newsletter written by Tanner Avery for the January 15th edition.

Last week President Trump floated the idea of capping the interest on credit cards at 10%, something socialist politicians like Alexandria Ocasio-Cortez and Bernie Sanders have been pursuing for years.

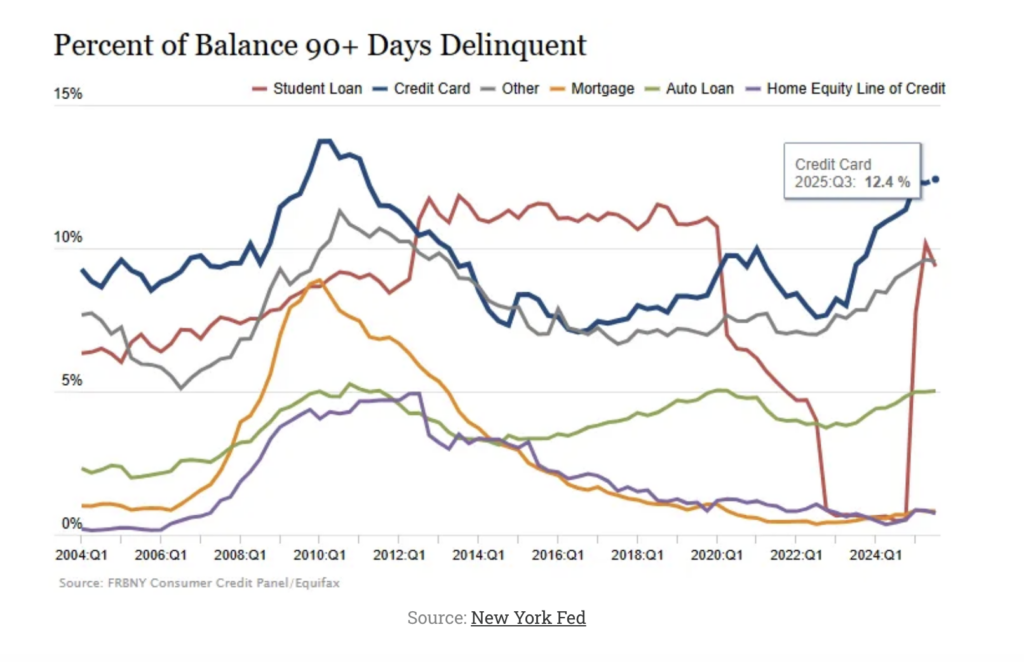

Families are feeling squeezed, which helps explain why rate caps sound like a quick fix. As economist Vance Ginn pointed out, about 12.4% of credit card balances are 90 or more days delinquent, levels similar to the Great Financial Crisis.

While the desire to help Americans struggling with affordability is laudable, this proposal is a mistake with consequences that would limit millions of Americans’ access to credit. To understand why, it is important to understand how interest rates actually work.

Interest rates, at their core, function as a price. In the case of credit cards, interest rates function as the price to borrow money. When government caps that price, lenders respond by reducing access to credit because they can no longer price for risk, especially for higher-risk borrowers. The most likely outcome of this proposal would be to remove access to credit cards for lower-income individuals, the exact group that relies on access to credit cards in emergencies.

And the data backs this up. A study by the Electronic Payments Coalition finds that 82 to 88 percent of Americans could potentially be cut off from consumer credit. That is not protecting vulnerable families. It is cutting them off from a financial lifeline.

Let’s be clear – this proposal is a form of government price control, and we already know how price controls play out because we’ve tried them before.

History offers a clear warning. As Andrew Gins at Americans for Tax Reform explains,

“In the 1970s, President Nixon famously froze prices and wages for 90 days to try and alleviate persistent inflation. The inflation was never solved but only suppressed temporarily. It took the Fed tightening the money supply in the 1980s to fix inflation for the next 40 years until the next inflationary episode was ignited by the Biden administration’s disastrous and profligate spending projects.”

Price controls did not fix the affordability crisis then, and they will not fix it now.

Government attempts to control prices address a symptom of unaffordability without facing the underlying policies that drive costs higher. Instead of intervening in the marketplace, policymakers wanting to address affordability should focus on getting government out of the way by restraining spending that drives inflation and cutting costly regulations that push prices higher.

Capping credit card rates won’t make life more affordable. It will only take away the very credit options families rely on when times are tight.