Introduction

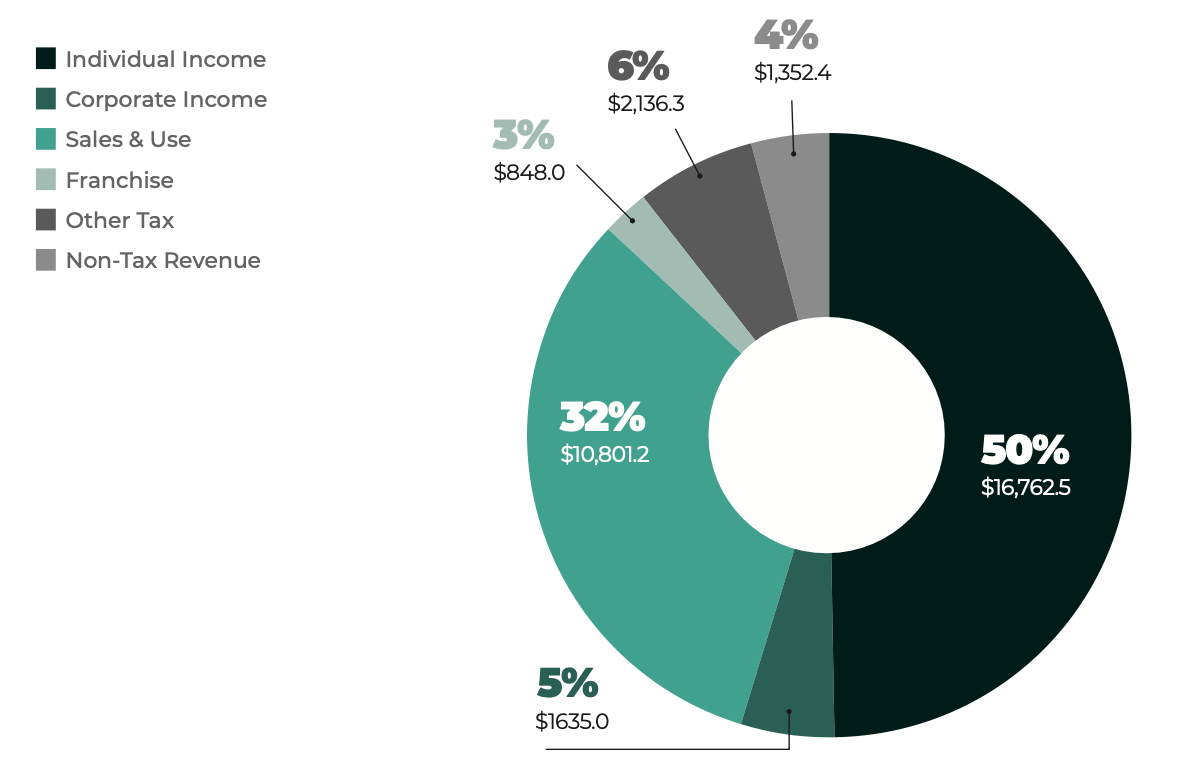

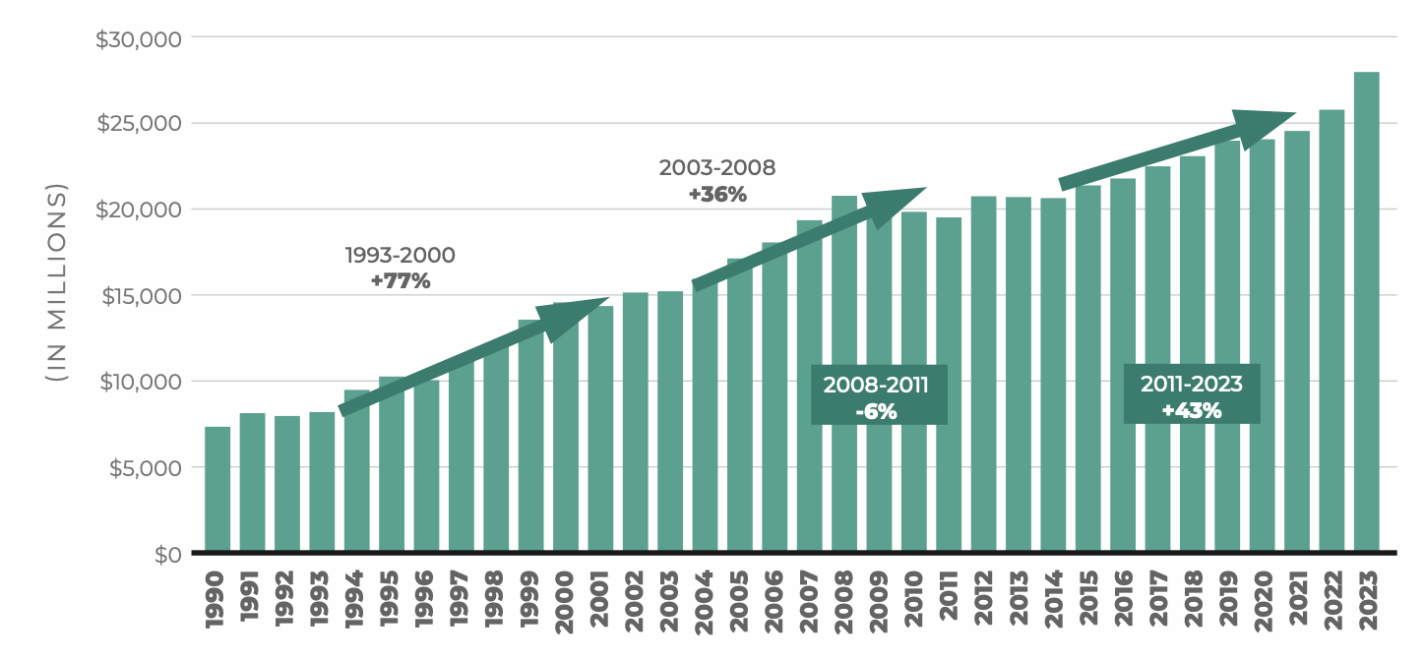

North Carolina has one of the strictest balanced-budget requirements in the country. State law holds the governor responsible for cutting expenditures to avoid a deficit. Republican leadership in the General Assembly since 2011 has helped by keeping inflation-adjusted General Fund appropriations per person in check. This spending restraint reversed more than three decades of fiscal irresponsibility, a period when increasing taxes to spend more was normal policy. Restrained spending has also made room to increase savings and cut taxes, leaving state finances better able to weather the next economic downturn.

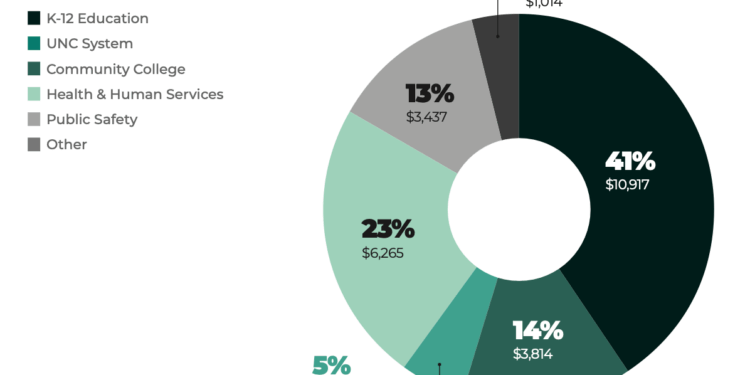

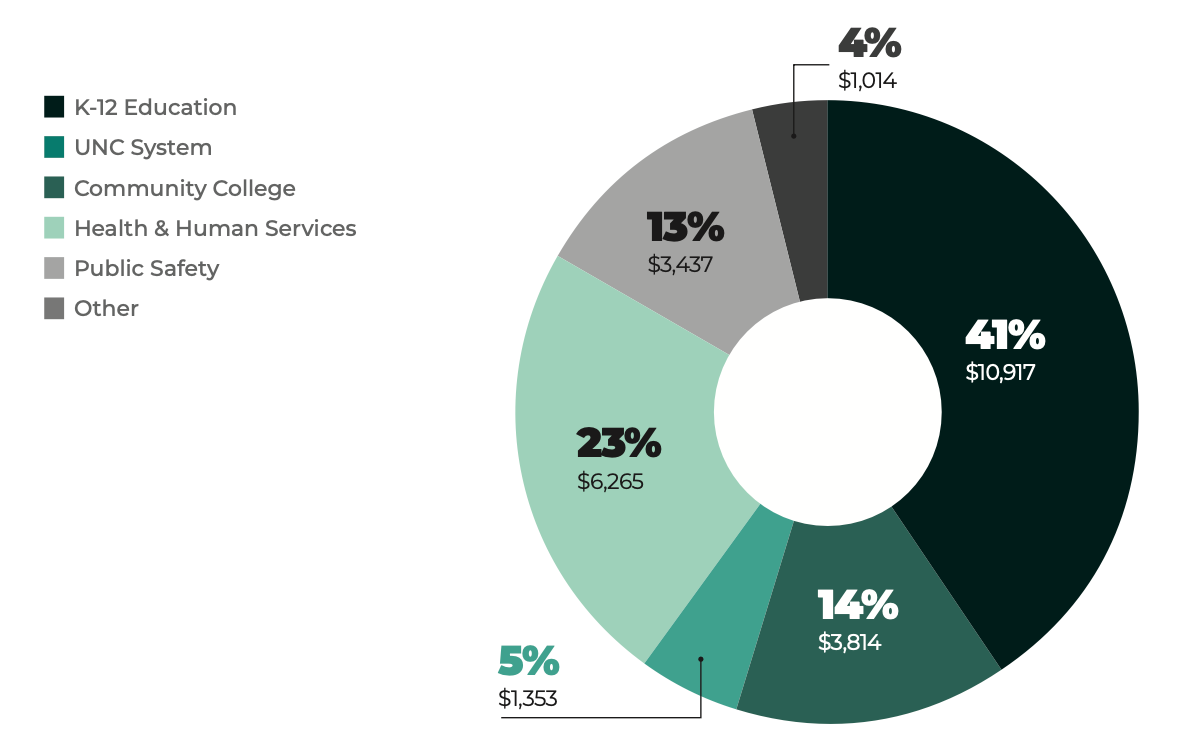

A close look at recent numbers shows that education, Medicaid, and public safety received 88 percent of the $27.9 billion in Fiscal Year (FY) 2022-23 General Fund appropriations, including debt service. Taxes on personal income and sales provided 83 percent of the $33.5 billion in FY 2022-23 General Fund revenues.

More specifically, however, the majority of General Fund expenditures are dedicated to paying salaries and benefits to employees and retirees. A 2022 Locke Foundation article reported that roughly 73 cents of every General Fund dollar spend goes toward employee salaries, employee health insurance benefits, pension contributions, and retiree healthcare benefits.

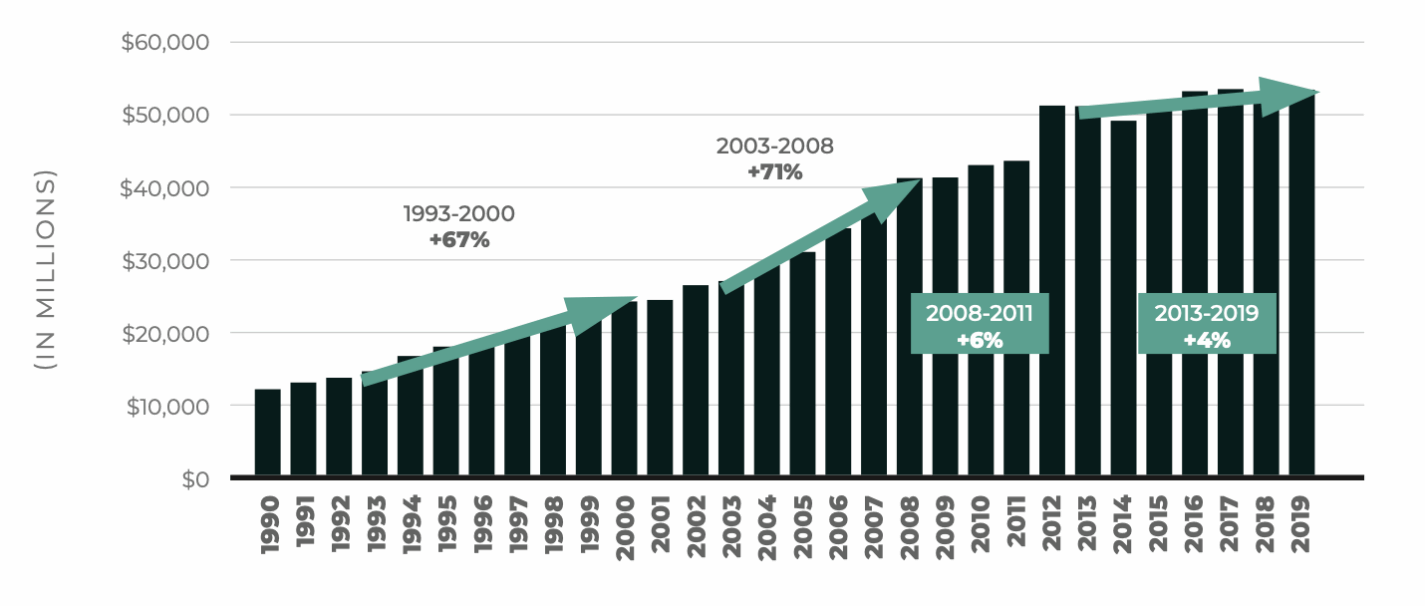

State government needs revenue to pay for the goods and services it provides, and the state raises that revenue by imposing personal income, sales, and other taxes on its residents. The General Fund, however, does not capture all of the state’s expenditures. Transportation expenses are provided for in the Highway Fund and Highway Trust fund, financed primarily by the state gas tax, that totaled $2.9 billion and $1.8 billion in FY 2022-23, respectively. Federal funds add about $20 billion. Lottery sales, tuition payments, unemployment insurance, and other sources contribute more than $5 billion, bringing total state spending to more than $55 billion.

Each source of funds poses intended and unintended consequences. Income taxes — particularly taxes on business income grow faster than the economy in good times and fall faster during recessions. Federal funds come with strings.

Spending and tax changes made today have long-term implications. Individual bills with fiscal implications receive five-year fiscal notes, but budget bills only cover the one or two years of the budget cycle. This lack of knowledge could make it more difficult to balance future budgets.

Key Insights

- Actual General Fund appropriations in FY 2022-23 totaled $27.9 billion, including debt service. Actual revenue collected during the year $33.5 billion, roughly $3 billion above projections. The year ended with the state’s Savings Reserve Fund at a historic high of $4.7 billion.

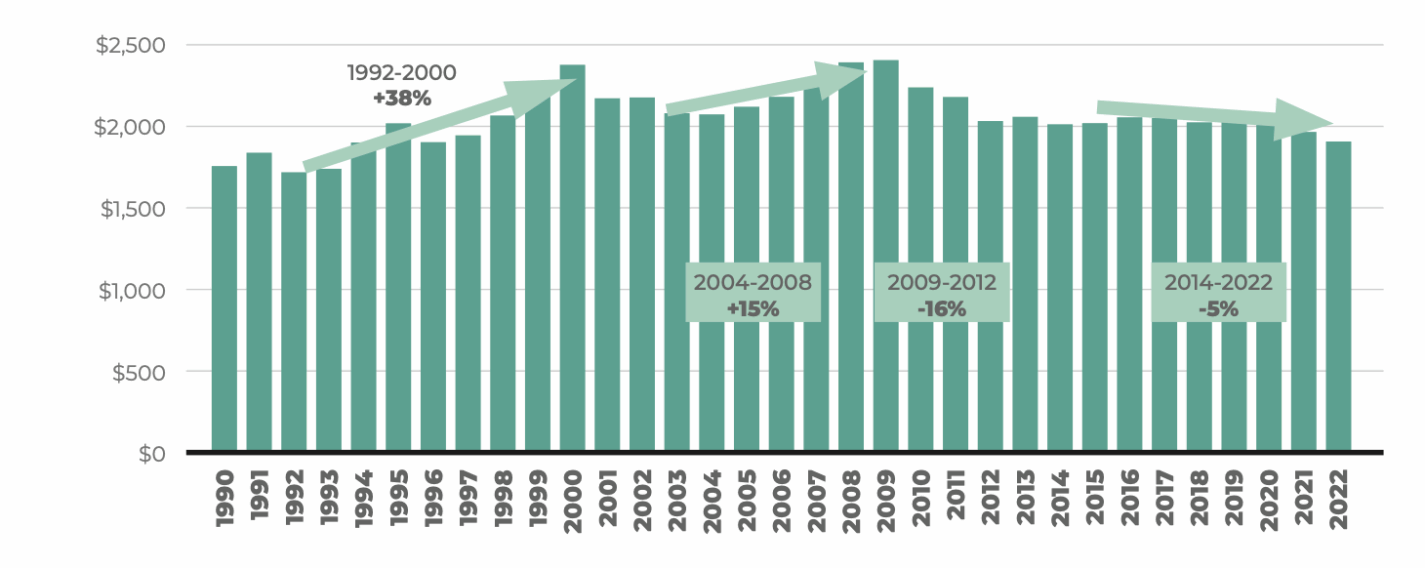

- In FY 1989-90, when the John Locke Foundation was launched, General Fund appropriations per person, adjusted for inflation, was $1,672. After peaking in FY 2008-9 at an inflation-adjusted $2,414, appropriations in FY 2021-22 were back to $1,913.

- The General Assembly finally passed a FY 2023-24 state budget in late September 2023. The total General Fund expenditures totaled $29.8 billion, however another $7.2 billion were set aside into various “reserves,” and therefore were off budget. Included in those set asides was a statutorily mandated allotment to the State Capital and Infrastructure Fund (SCIF), but billions more were diverted to economic development funds that should have been included in the General Fund appropriations. Such measures mask the true amount of spending.

- Government savings in the Rainy-Day fund, also known as Savings Reserve, climbed to $2.0 billion before Hurricane Florence in 2018. As of July 2023, it stood at $4.75 billion.

Recommendations

- Amend the State Constitution to Limit Spending and Spending Growth.

A proper amendment would (1) allow tax hikes or higher spending growth only if approved by public referendum or a legislative supermajority, (2) deposit excess revenue in the Savings Reserve or refund taxpayers, (3) prevent ratchet effects from recessionary spending cuts, and (4) apply to General Fund and total spending. Commonly referred to as a Taxpayer Bill of Rights (TABOR), such restraints would cap annual spending growth to a formula tied to population plus inflation growth. - Save for Recession, Natural Disasters, and Variable Revenues.

State government should continue to leave money in an unreserved cash balance or in the Savings Reserve to mitigate the desire for tax increases when storms hit or revenues slow. When recession depletes reserves, the reserve fund should be built back up again once the economy recovers. - Implement the “Insko Rule.”

To increase transparency and accountability, every special spending provision asked for in the budget should be accompanied by the name or names of the legislators making the request. The public should know who is requesting that their tax dollars be spent on pork and earmark projects. The rule is named after Verla Insko, a longtime Orange County Democrat legislator who proposed such legislation in 2017. - Stop Creating New “Reserves” to Divert Money Off Budget.

Diverting money into various economic development and miscellaneous “reserves” harms transparency. Such spending should be itemized in the General Fund rather than sent into a reserve where the expenditures become nearly impossible to track. Also, the diversion of such funds masks the true amount of spending occurring.

Where Does the Money Go?

FY 2022-23 General Fund Expenditures (in Millions)

Note: “Other” includes: Gen. Gov., Econ. Development, Environment & Nat Res. and Agriculture

Sources: Office of the State Controller

Where Does the Money Come From?

FY 2022-23 General Fund Revenue (in Millions)

Note: Totals may not sum to 100% due to rounding

Sources: Office of the State Controller

General Fund Appropriations

Sources: General fund expenditures taken from FY 2019–21 governor’s recommended budget, Office of State Budget & Management, Appendix Table 2B. Accessed online June 21, 2021 at: https://www.osbm.nc.gov/budget/governors-budget-recommendations/past-recommended-budgets/2019-21-governors-recommended-budget. Expenditures from subsequent years taken from the respective budget bills.

General Fund Appropriations Per Person

Adjusted for Inflation

Sources: Office of State Budget and Management, GDP deflator levels from Federal Reserve Bank of St. Louis.

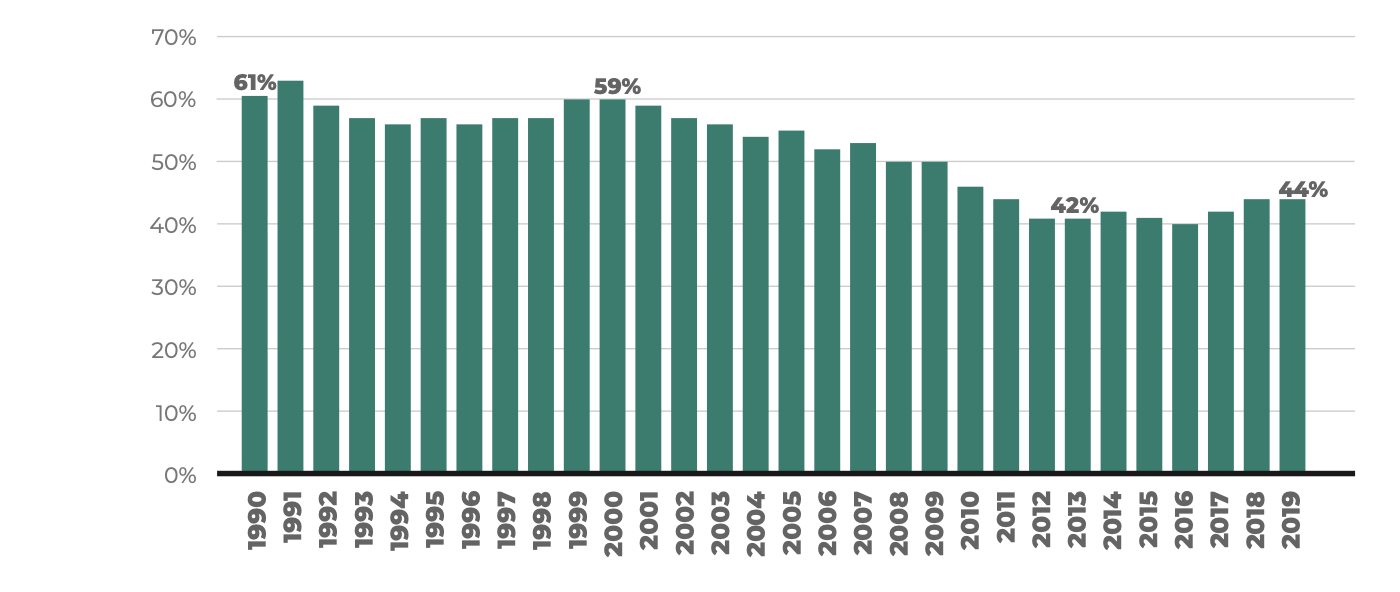

General Fund Share of Total Spending

Sources: Office of the State Controller

Total Spending

Sources: Office of the State Controller