Introduction

For many years, economists and tax policy researchers maintained that North Carolina’s tax system needed a major overhaul. The system was a model of hodgepodge tax policy with high marginal rates on personal and corporate incomes and many exemptions carved out for the favored few. This led to a tax system that generally penalized investment, entrepreneurship, economic growth, and therefore job creation.

The process of improving the tax code began in 2011. A 1% temporary increase in sales tax put into effect in 2009 was set to expire. North Carolina Gov. Beverly Perdue was in favor of continuing the higher rate past its expiration date. Ultimately, it was allowed to sunset, but only because of an override of Gov. Perdue’s veto of legislation by the newly elected Republican majority in the North Carolina General Assembly.

In 2013, the General Assembly implemented fundamental tax reform, which has become a model for states across the country. From the perspective of economic growth, the two most important improvements were pro-growth reforms in the personal and corporate income taxes. In addition, lawmakers also incorporated across-the-board tax cuts that would benefit most households in all income groups. The deliberative process that led to these changes was thoughtful and, in large part, ignored the kind of special-interest pleadings that typically plague such reform efforts.

Subsequent, smaller reforms have continued to improve North Carolina’s tax code, so much so that the Tax Foundation ranked North Carolina as having the 10th best business tax climate in the nation in 2023. In 2012, just prior to the major 2013 reforms, North Carolina ranked 7th worst in this index.

During the 2021 legislative session, the General Assembly continued its tax-cutting ways when it approved a budget plan including personal income tax cuts, a phaseout of the corporate tax by 2029, and a reduction in the franchise tax. The 2023 budget increased the rate of the personal income tax cuts, putting them on schedule to fall to 3.99% in 2026, with a path to reach 2.49% through 0.5% annual increments in years in which certain revenue targets are met.

While this progress is laudable, more improvements should be made. North Carolina’s tax code still has some features that are biased against saving and investment. In particular, by taxing interest and capital gains, the state tax code imposes a double tax on all saved income. This needs to be remedied. The corporate tax phaseout should be preserved, and the franchise tax should be eliminated. Meanwhile, the state’s continued use of targeted tax breaks to politically favored corporations should end.

Key Facts

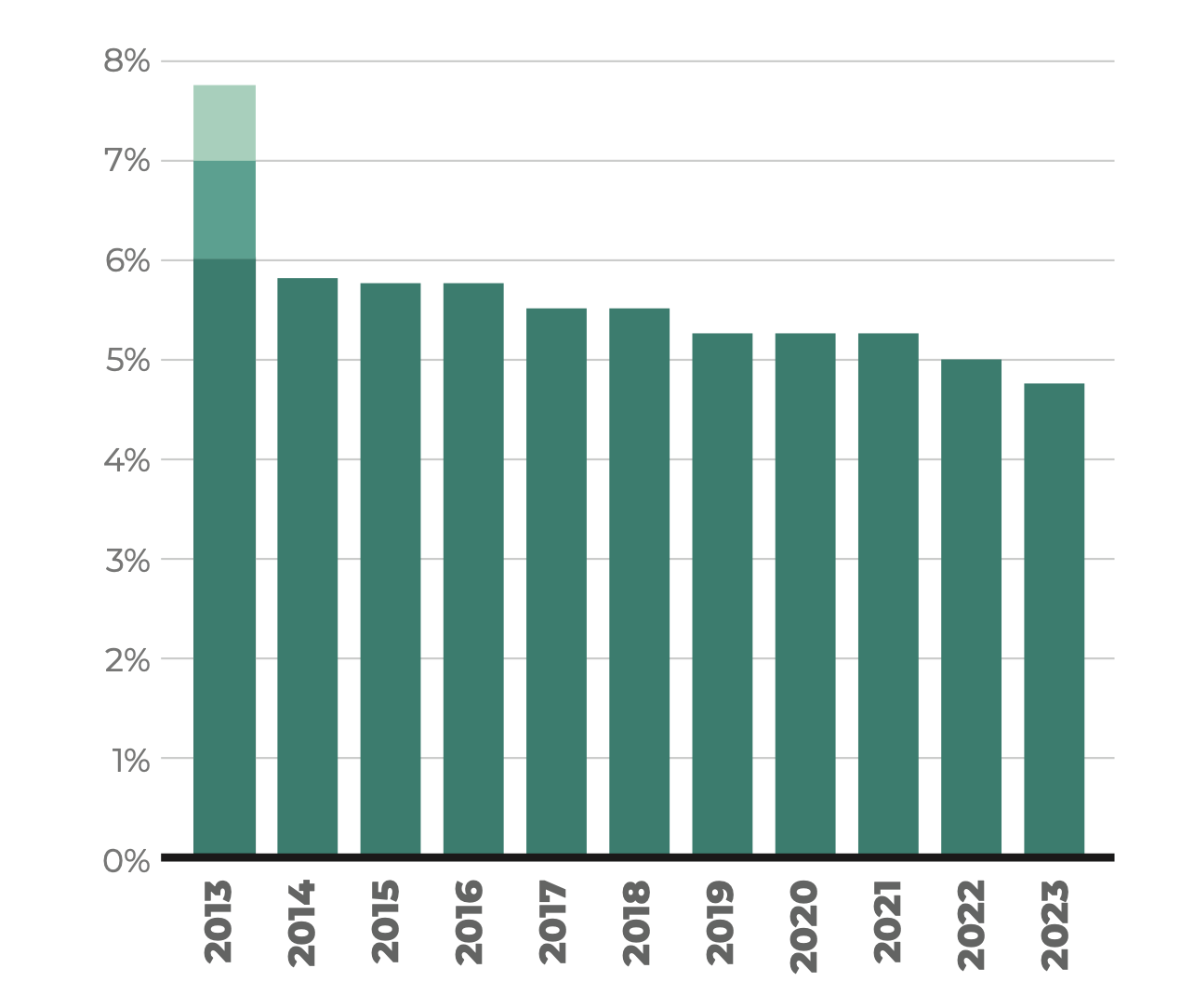

- The 2013 tax reforms replaced a three-rate progressive income tax that ranged from 6% to 7.75%, the highest in the region, with a flat-rate tax of 5.8%. This rate was subsequently lowered to 5.499%, then to 5.25%, and then to its current rate of 4.99%, which took effect in January 2022. The rate is now scheduled to fall to 3.99% by 2026, with a path to 2.49% contingent on revenue targets being met. The relatively low, flat personal income tax rate has ameliorated the bias against work effort and productivity that plagued the previous progressive rate structure.

- The standard deduction, also known as the zero-tax bracket, has been dramatically increased from $6,000 prior to the 2013 reforms to $25,500 for a couple filing jointly in 2022. This was a way of building progressivity into what is essentially a flat-rate system.

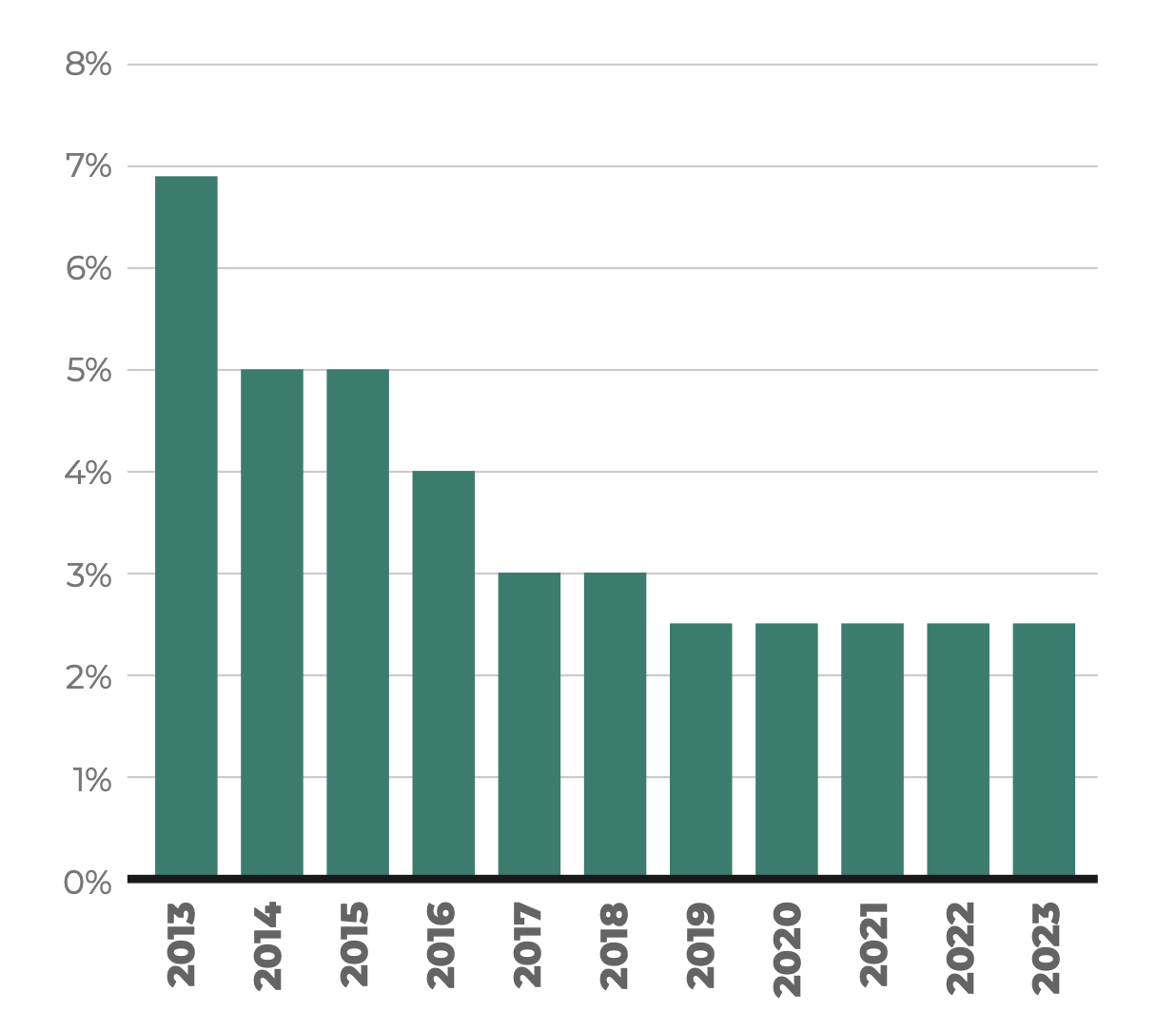

- The corporate tax rate has been reduced from 6.9% in 2012, the highest in the Southeast, to the current rate of 2.5%, the lowest of any state that taxes corporate income. The 2021 budget included a phaseout of the tax by 2029.

- The state sales tax rate did not change, but the base was expanded to include some services. Business-to-business sales continue to be taxed.

- North Carolina continues to double tax saving and investment by taxing investments and capital gains. Full repeal of the capital gains tax would save taxpayers from paying a “double tax” on gains from investments made with money that had already been taxed by the income tax.

Recommendations

1. Future reform efforts should focus on excluding savings from the tax base.

This would eliminate the bias against saving, investment, and entrepreneurship that still exists in the tax code. A good first step in this direction would be to eliminate taxation on capital gains or, at the very least, to create a capital gains exclusion. The reduction in revenue to the treasury from reducing or abolishing the capital gains tax should be replaced by eliminating economic development programs that subsidize business. (See Economic Growth.)

2. Index the “Zero Tax Bracket” to Inflation.

The income tax’s standard deduction should be indexed to inflation so that wage increases merely keeping up with inflation (or not rising as fast as inflation) do not get pushed up into the taxable income category.

3. Eliminate the Capital Gains Tax and Franchise Tax.

These taxes are particularly harmful to wages, investment, and economic growth. The 2023 budget placed a cap on the franchise tax, and legislators should take the next step by eliminating it.

4. Businesses Should Be Allowed to Deduct All Purchases of Capital Equipment and Land in the Year They Are Incurred, a Practice Known as Expensing.

This approach has recently been adopted at the federal level and will also apply to North Carolina. But federal policy in this regard will expire after five years. North Carolina should go beyond federal tax policy and make immediate expensing a permanent feature of the tax code.

5. There Should Be a Moratorium on Any New Expansion of the Sales Tax Base Until Business-to-Business Sales Are Exempted From the Tax.

This is a hidden double tax embedded in the system.

Personal Income Tax Rate In North Carolina

Note: 2013 personal income taxes are split up as low, middle, and high for that year

Source: John Locke Foundation research

Corporate Income Tax Rate In North Carolina

Note: 2013 personal income taxes are split up as low, middle, and high for that year

Source: John Locke Foundation research