New data shows a dramatic increase in local government debt last year, which drove property taxes higher and worsened the cost-of-living crisis.

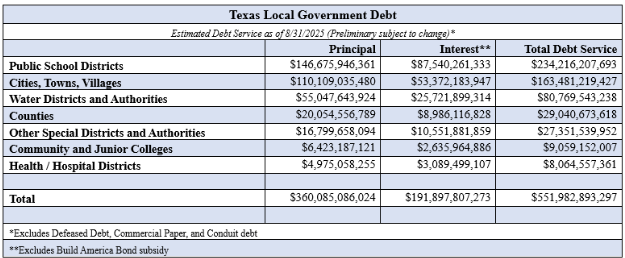

According to the Bond Review Board’s latest estimates, the total amount owed by cities, counties, school districts, and special districts rose to nearly $552 billion in fiscal year (FY) 2025. Shockingly, that massive sum is more than $52 billion higher than the prior year’s amount.

Once again, independent school districts (ISDs) were the most heavily indebted type of political subdivision, with ISD debt reaching $234.2 billion or approximately 42% of the total. This sum represents a $31.6 billion increase over the previous year (FY 2024) and indicates that ISDs collectively owe around $42,000 for every student currently enrolled.

The next biggest borrowers were municipalities ($163.4 billion or 29.6%), water districts ($80.7 billion or 14.6%), and county governments ($29 billion or 5.3%).

The rate of growth presently on display should be a top concern for Texas policymakers, as rapid debt accumulation threatens higher taxes, bigger government, and slower economic growth. Too, there is mounting concern that public debt consumption is fueling “a vast network of vendors, administrators, consultants, lobbyists, associations, and political organizations that work together to squander taxpayer money.”

In light of these concerns, it would be prudent for the next Texas Legislature to institute a series of good government reforms aimed at promoting trust, transparency, and accountability. The types of reforms that lawmakers should consider include:

- Simplification. A requirement that bond propositions include 1-2 simple sentences above any proposition language to describe the measure’s general cost and purpose. The sentences should be written at an 8th grade reading level, which will allow for more widespread understanding.

- Reasonable Start Time. A requirement that projects funded through voter-approved bonds start within a reasonable timeframe (i.e., 3 -5 years maximum), lest the funding expire.

- Price Tag. A requirement that local governments include a cost estimate along with any proposition language, so that voters understand how the average homeowner’s tax bill will increase (decrease) if the measure is approved.

- Supermajority Approval. A requirement that two-thirds of the voting public approve any bond issuance—or tax increase—for the measure to take effect. This will ensure that proposals to borrow more and raise taxes enjoy broad community support.

- Uniform Election Date. A requirement that bond elections be held on the November uniform election date. This will ensure maximum community input.

Together, the enactment of these reforms, along with the many others discussed in the report, promise a better path forward on public debt. It’s well past time to take aggressive action in this space and protect Texas taxpayers from insatiable local governments.