Later today, both the Texas House and Senate will consider the conference committee report for Senate Bill 10, a proposal to reduce certain taxing units’ voter-approval tax rate (VATR) from 3.5% to 2.5%. In so doing, lawmakers hope to create the conditions for increased public participation in the tax rate-setting process and slow the relentless march of tax levy growth not directly approved by voters.

While the measure is limited to only large population centers, specifically, those with a population of 75,000 and above, its passage is expected to further strengthen the VATR, which is a key aspect of Texas’ property tax revenue limitation (PTRL) that has only really been in effect since 2019. Prior to the passage of the Texas Property Tax Reform and Transparency Act of 2019 and its school finance counterpart, a more burdensome ad valorem system stood for almost 40 years, wherein taxing units were allowed to raise taxes by as much as 8% annually and the public was forced to utilize a cumbersome petition election process to challenge large tax increases above the threshold.

Even though those 2019 changes have only been effective for a short time, there’s already evidence to suggest that taxpayers are much better off.

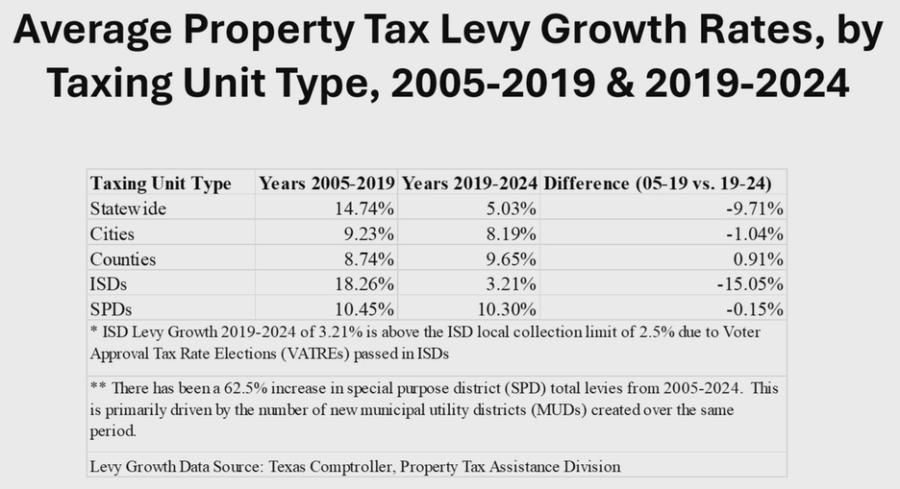

At an August hearing in the Senate Committee on Local Government, the chart below was prominently featured to illustrate the effect of Texas’ tax reform efforts. In it, we may observe the average annual property tax levy growth rate both before and after these changes went into effect.

Source: Senate Committee on Local Government, August 1st hearing

What the data indicates is that from 2005 to 2019, statewide tax levies grew at an average of 14.74% per year, which is both quite high and oppressive. This elevated rate of growth was driven in large part by outsized ISD tax levy growth, which rose on average by 18.26% per year. Following the introduction of a 3.5% VATR for most cities, counties, and special districts plus a 2.5% trigger for ISDs, the statewide tax levy growth rate was held to just 5.03% per year for 2019 through 2024, marking an almost 10% growth rate differential between the two periods. For ISDs, the annual average tax levy growth rate fell to just 3.21% per year, which is still slightly higher than the ideal 2.5% limit but is markedly better than the previous measure.

On the basis of this data, at least 2 things appear evident. First, the Legislature’s efforts to modernize the PTRL have noticeably improved the property tax levy’s trajectory, at least from a taxpayer perspective. This effect is most noticeable with respect to school taxes. Second, policymakers could stand to tighten the limits further, as there has not been a tremendous change in city and county growth rates. Some of this stubbornly high growth may be related to the tax cut opportunism on display in many localities, but likely also includes other factors too.

Whatever the case, the Legislature’s expected adoption of SB 10 later today is both welcome and needed. By lowering the VATR for large taxing units, policymakers will improve upon an existing limit that has proven effective and move us one step closer to having one uniform standard in place for all taxing units, thereby helping taxpayers to understand and engage with Texas’ tax system irrespective of geography or government type.